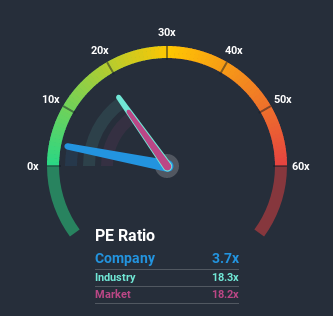

Flow Traders N.V.’s (AMS:FLOW) price-to-earnings (or “P/E”) ratio of 3.7x might make it look like a strong buy right now compared to the market in the Netherlands, where around half of the companies have P/E ratios above 19x and even P/E’s above 43x are quite common. Although, it’s not wise to just take the P/E at face value as there may be an explanation why it’s so limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Flow Traders has been doing quite well of late. One possibility is that the P/E is low because investors think the company’s earnings are going to fall away like everyone else’s soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Flow Traders

How Is Flow Traders’ Growth Trending?

Flow Traders’ P/E ratio would be typical for a company that’s expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 495%. Pleasingly, EPS has also lifted 506% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 34% each year during the coming three years according to the four analysts following the company. With the market predicted to deliver 18% growth each year, that’s a disappointing outcome.

With this information, we are not surprised that Flow Traders is trading at a P/E lower than the market. Nonetheless, there’s no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Typically, we’d caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Flow Traders’ analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn’t great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Flow Traders (1 is potentially serious!) that we have uncovered.

It’s important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

Promoted

If you decide to trade Flow Traders, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

These great dividend stocks are beating your savings account

Not only have these stocks been reliable dividend payers for the last 10 years but with the yield over 3% they are also easily beating your savings account (let alone the possible capital gains). Click here to see them for FREE on Simply Wall St."flow" - Google News

August 24, 2020 at 06:14PM

https://ift.tt/2Ytu1gK

Investors Aren’t Buying Flow Traders N.V.’s (AMS:FLOW) Earnings - Simply Wall St

"flow" - Google News

https://ift.tt/2Sw6Z5O

https://ift.tt/2zNW3tO

Bagikan Berita Ini

0 Response to "Investors Aren’t Buying Flow Traders N.V.’s (AMS:FLOW) Earnings - Simply Wall St"

Post a Comment