By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. Just take a look at Flow Traders N.V. (AMS:FLOW), which is up 26%, over three years, soundly beating the market decline of 9.2% (not including dividends).

See our latest analysis for Flow Traders

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

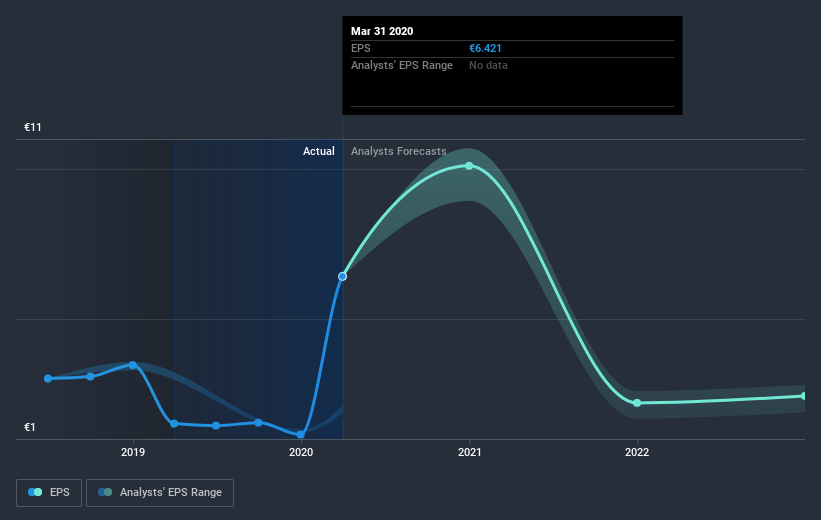

Flow Traders was able to grow its EPS at 54% per year over three years, sending the share price higher. This EPS growth is higher than the 8.1% average annual increase in the share price. Therefore, it seems the market has moderated its expectations for growth, somewhat. This cautious sentiment is reflected in its (fairly low) P/E ratio of 4.86.

The company’s earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Flow Traders’ earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Flow Traders’ TSR for the last 3 years was 44%, which exceeds the share price return mentioned earlier. And there’s no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We’re pleased to report that Flow Traders shareholders have received a total shareholder return of 26% over one year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 1.8%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we’ve discovered 3 warning signs for Flow Traders (2 make us uncomfortable!) that you should be aware of before investing here.

Flow Traders is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.

Promoted

If you decide to trade Flow Traders, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

"flow" - Google News

August 03, 2020 at 03:35PM

https://ift.tt/33nR1Rw

If You Had Bought Flow Traders (AMS:FLOW) Shares Three Years Ago You’d Have Earned26% Returns - Simply Wall St

"flow" - Google News

https://ift.tt/2Sw6Z5O

https://ift.tt/2zNW3tO

Bagikan Berita Ini

0 Response to "If You Had Bought Flow Traders (AMS:FLOW) Shares Three Years Ago You’d Have Earned26% Returns - Simply Wall St"

Post a Comment