mevans/E+ via Getty Images

Berkshire Hathaway's history of buying into OXY

Occidental Petroleum Corporation (NYSE:OXY) has just seen its largest shareholder Berkshire Hathaway (BRK.A) (BRK.B) add to its position in the company. Berkshire already owned ~217 million shares and added another almost ~5 million late May. This additional lot of shares was bought at average prices of slightly above $58 a share. Berkshire now controls around 25 % of OXY.

Berkshire started investing in OXY in 2019 when it helped bankroll OXY's takeover of Anadarko Petroleum. The OXY position has been increased several times since through common stock purchases, sparking speculation that Berkshire would eventually take control of OXY. If Berkshire ever did buy out OXY, it would be the biggest ever deal made by the conglomerate.

In August 2022, Berkshire was cleared by regulators to acquire up to a 50 % ownership stake of OXY, adding to the "fire" of speculation.

During the 2023 Berkshire Hathaway annual meeting, Warren Buffett made comments on the OXY position, saying:

We will not be making any offer for control of Occidental - Warren Buffett, CEO

What Mr. Buffett hence is saying, in my view, is that Berkshire won't be making an offer to buy OXY all at once.

The are many good reasons for this: If Berkshire were to make an offer to buy OXY in one scoop, they'd have to convince the board of OXY that their offer should be accepted by shareholders. The board probably wouldn't recommend taking the offer unless there's a substantial premium to market. But paying a premium to market is just not Buffett's idea of sound investing. It's out of character.

This leaves Berkshire to buying in the open market where the price is determined by buyers and sellers without needing to pay a premium. Of course, buying the entire company this way seems unlikely since each block purchased by Berkshire would represent a fairly small percentage of shares outstanding. If Berkshire were to deploy its vast cash resources to buy the entire trading volume of OXY, that would seriously push up the price. Also not desirable to the Oracle of Omaha.

But then there's another option: As part of Berkshire's financing of OXY's buy-out of Anadarko, Berkshire obtained millions of warrants to buy further stock at a pre-determined price. Berkshire holds roughly 84 million warrants to buy OXY stock at approximately $59.5 per share. Exercising those warrants would add an additional ~10 % ownership stake to Berkshire's existing ~25 % stake.

In February 2023, OXY announced a $3B share repurchase plan. This allows the company to reduce the current share count by about 5 %. Buybacks have been taking place throughout the year. Much of the buyback activity is probably due to the excess cash generated by the strong COVID re-bound of oil and the price increase caused by the war in Ukraine. But it's also following a general trend for oil companies to buy backs shares, and it pushes up Berkshire's percentage ownership of OXY by reducing the amount of shares in circulation not held by Berkshire.

This combination of open market purchases, potential exercising of warrants, and substantial stock buybacks could see Berkshire someday owning a much larger stake of OXY. But there's no saying that will leave Berkshire in control, and we'll have to take Mr. Buffett on his word that that is also not the intent.

So even if Berkshire is not attempting to take over control of OXY, the continued buying of shares leaves a question: If Warren Buffett likes OXY so much - and might someday control the company - should you invest alongside him?

This is what Buffett sees and why you might want to invest alongside him

US crude oil prices have retreated recently. With the oil & gas sector being largely a commodities (price) driven business, it's interesting to analyze Buffett is buying OXY at this point.

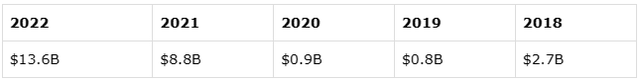

One good reason could be OXY's massive free cash flow. This free cash flow has grown to record numbers in the aftermath of COVID and during the war in Ukraine:

Analyst's presentation, data from SEC filings and Ycharts.com

For 2022 alone, OXY generated more than $13 billion of free cash flow. This easily covers the entire long-term debt sitting on OXY's balance sheet at ~$9.5 billion. OXY's 5-year free cash flow is ~$5 billion, so even accounting for the COVID years, OXY is conservatively financed. I believe the combination of conservative financing and strong cash flows appeal to Buffett. In any event, the free cash flow profile of OXY and the opportunities created from that is one reason you might want to invest in the company.

A second reason for buying could be the growth prospects of OXY. One such avenue of growth I would like to highlight here is that of OxyChem, the chemicals division of OXY. In 2022, OxyChem displayed record EBIT of $2.5 billion. For the fourth quarter of that year alone, this division produced $457 million of pre-tax income. As part of OXY's growth strategy, OXY will modernize the OxyChem Battleground chemical plant. On a technical level, OXY will convert to newer technologies and thereby expects to lower both maintenance capital spending and greenhouse gas emissions. OXY further expects the plant modernization to improve cash flow through reduced operating costs and higher product volumes. This alongside OXY's general attempts to keep up and increase oil production volumes could be something appealing to Buffett.

A third reason for buying could be the price. OXY trades at a P/E of ~6.75 as of June 9, which of course is substantially lower than the general market but also fairly low compared to the other US Big Oil players:

| Company | P/E |

| Chevron | 8.59 |

| ConocoPhillips | 8.29 |

| Exxon Mobil | 7.27 |

| Occidental Petroleum | 6.75 |

| Phillips 66 | 3.82 |

| Marathon Petroleum | 3.41 |

Certainly, with P/E ratios in this range, the market has not priced in much growth. This again is probably caused by the cyclical nature of the industry and the fact that we've seen record years following COVID. So some decline is expected - but also already priced in, perhaps setting up the OXY stock for gains once a new upward swing occurs.

Aside from buying based on fundamentals alone, you could of course actually speculate that Berkshire will eventually want to buy out remaining shareholders - if nothing else following a spree of Berkshire buys in the open market and substantial further buybacks from OXY itself. This could, theoretically at least, cause a situation where Berkshire would benefit from submitting a buy-out offer since the company would be in de facto control anyway. This of course comes with the risk that you'd be acting against the word of Mr. Buffett.

Key takeaways

I'm rating OXY a Buy because aside from being of investment interest to one of the greatest investors of all time, OXY presents an interesting combination of 1) strong free cash flows that lead to investor returns, including substantial buybacks, and 2) OXY presents growth prospects, including that of their chemicals division and the general push to increase oil/gas production, and 3) not least the fact that OXY trades at low multiples that makes valuation seem attractive.

Aside from the more rational reasons for buying, you could speculate that Berkshire will eventually buy OXY. This could happen based on a combination of open market purchases, buybacks, warrants etc. - and subject to the required regulatory approval which would be needed if Berkshire's stake in OXY was to surpass the already approved 50 %.

Do you agree or disagree with this analysis? Let me know in the comments below.

"flow" - Google News

June 10, 2023 at 06:25PM

https://ift.tt/2Sw0enj

Occidental Petroleum: Strong Free Cash Flow And Growth Opportunities Ahead (NYSE:OXY) - Seeking Alpha

"flow" - Google News

https://ift.tt/PAzw8jY

https://ift.tt/7A14rWM

Bagikan Berita Ini

0 Response to "Occidental Petroleum: Strong Free Cash Flow And Growth Opportunities Ahead (NYSE:OXY) - Seeking Alpha"

Post a Comment