While Google parent Alphabet reported lackluster earnings after the closing bell on Tuesday, the tech giant did report strong free cash flow for Q3. Alphabet reported more than $16 billion in free cash flow for the quarter that ended September 30.

Free cash flow is the cash left over after a company has paid expenses, interest, taxes, and long-term investments. It is used to buy back stocks, pay dividends, or participate in mergers and acquisitions.

“We provide free cash flow because it is a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that can be used for strategic opportunities, including investing in our business and acquisitions, and to strengthen our balance sheet,” said Alphabet’s earnings release.

And according to FCF Advisors, that’s the better metric for profitability than earnings.

Bob Shea, CEO and CIO of FCF Advisors, told VettaFi that his firm believes that while “GAAP earnings have significant disadvantages,” and “accounting practices allow a lot of leeway and discretion to management… The ability to manipulate and distort free cash flow is a lot more difficult than with earnings.”

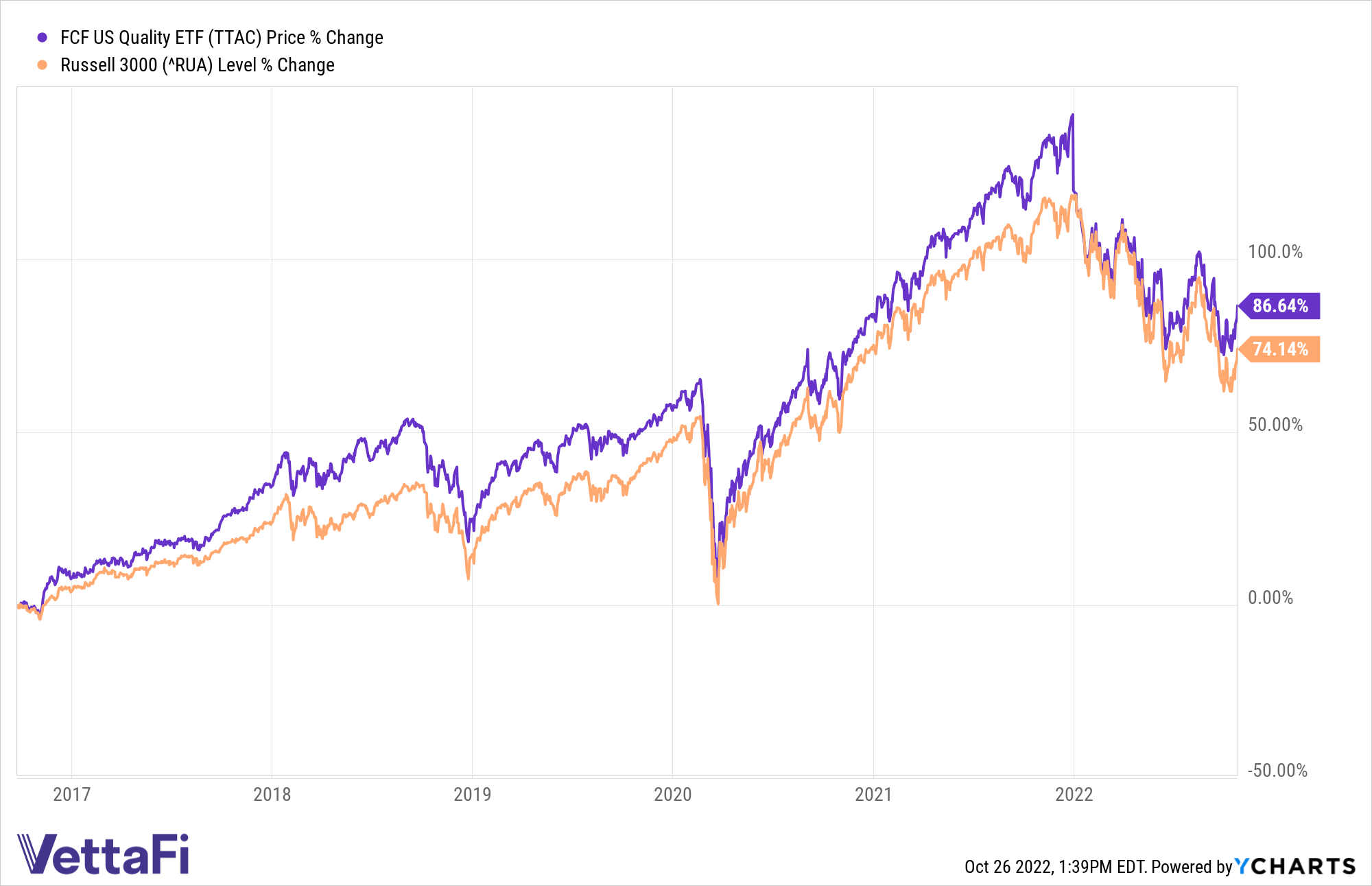

Alphabet was among the top holdings of the FCF US Quality ETF (TTAC) as of September 30. TTAC aims to outperform the Russell 3000 through a fundamentals-driven investment process that selects an average of 144 stocks based on free cash flow strength. Its holdings are then weighted by a modified market-cap log transformation, allowing increased exposure to companies with the strongest proprietary free cash flow rankings.

TTAC’s portfolio will also be rated with an ESG score, excluding companies with low ESG ratings. Firms with an extreme rise in shares count and increase in leverage are excluded.

Since its inception, TTAC has outperformed the Russell 3000 by nearly 1300 basis points.

“Free cash flow is so important right now, given that the allocation environment has gotten exponentially more difficult in 2022,” Shea said. “Cohorts have never seen an environment like this. In a difficult environment, people want to make sure they understand what they own.”

For more news, information, and strategy, visit the Free Cash Flow Channel.

"flow" - Google News

October 27, 2022 at 01:16AM

https://ift.tt/DS9W7xK

TTAC Takes Advantage of Google’s Free Cash Flow - ETF Trends

"flow" - Google News

https://ift.tt/sT6XP57

https://ift.tt/Ev23X4C

Bagikan Berita Ini

0 Response to "TTAC Takes Advantage of Google’s Free Cash Flow - ETF Trends"

Post a Comment