The pandemic-induced shackles on U.S. E&P capital spending were shattered by rising commodity prices in 2022, and total investment for the 42 producers we follow rose a dramatic 54% over 2021. But E&Ps haven’t abandoned the fiscal discipline or focus on cash-flow generation that allowed them to survive COVID-related demand destruction and resuscitate investor interest. Their 2023 capital budgets generally sustain the pace of Q4 2022 spending and reflect a modest 17% increase over full-year 2022. However, commodity price trends and changes in investment opportunities have resulted in significant shifts in the allocation of the total investment among the major U.S. unconventional plays. In today’s RBN blog, we’ll analyze 2023 capital spending, region by region.

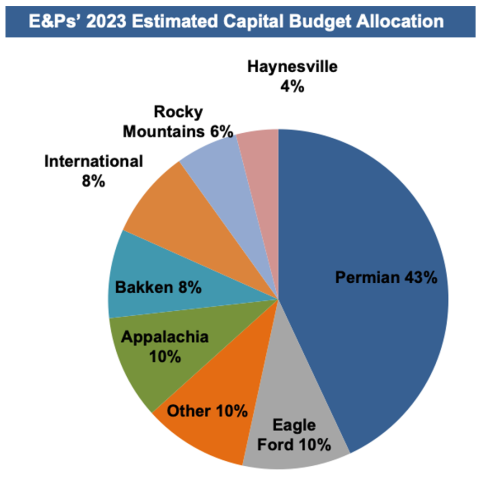

Figure 1 shows the regional allocation of the $71.3 billion in estimated 2023 capex for the 42 publicly traded E&Ps we cover. (That group includes every publicly held U.S. E&P with a market capitalization over $500 million, but not integrated energy companies like ExxonMobil and Chevron.) As it has for several years, the Permian Basin (dark-blue slice) garners by far the largest share of total investment at 43%. The total capital budgeted for the play is expected to rise by 17%, matching the overall capex increase. However, the allocations for other regions reflect significant changes. Investment in the Eagle Ford (gray slice), Bakken (aqua slice), and Rocky Mountains (light-blue slice) is expected to increase by 32%, 36% and 26%, respectively. On the other hand, Appalachia capex (green slice), which increased 64% in 2022, will rise by just 9%, while Haynesville Shale spending (pink slice) will be flat from the previous year. Below, we review the changes in spending and the reasons behind them for each U.S. unconventional play.

Figure 1. E&Ps’ 2023 Estimated Capital Budget Allocation. Source: Oil & Gas Financial Analytics, LLC

As we said, U.S. E&Ps are allocating 43% of their 2023 drilling-and-completion spending to the Permian Basin. The proportion of total investment has stayed constant over the last four years, but the $30.6 billion in guidance represents a 17% increase over 2022 outlays and a return to the pre-pandemic level of $30.1 billion in 2019. Energy Information Administration (EIA) statistics show total Permian production increased 10% in 2022, in line with the reported output rise in the E&Ps we follow. These producers are guiding to more modest mid-single-digit production growth in 2023.

ConocoPhillips has slotted the highest Permian investment at $4.7 billion, a 13% increase over the previous year. Rig and frac crew activity will maintain the accelerated pace from the second half of 2022, and the company expects some “modest growth” in partner activity as the year progresses. The company expects mid-single-digit production growth in 2023, weighted toward the second half of the year. Pure Permian producer Pioneer Natural Resources has boosted its 2023 investment by 14% to $4.6 billion, which reflects 10% inflation in services costs and two incremental rigs that support its targeted 4% growth in oil output and total production. Pioneer has highlighted two “key projects” within this expanded budget: the drilling of four exploration wells targeting the Barnett and Woodford formations in the Midland Basin and continued appraisal of an enhanced oil recovery (EOR) project.

Interestingly, Occidental Petroleum’s $2.3 billion budget for this play reflects both of Pioneer’s objectives. Although the company’s goal is to hold output flat, it is raising investment in the play by 7% to return to maintenance-level spending for its substantial Permian EOR program and targeting appraisals of the oil potential in the Barnett formation in West Texas — hitherto famous as the source rock of the unconventional gas play that jump-started the Shale Revolution in the Dallas/Fort Worth area. Diamondback Energy’s $2.33 billion budget also includes “three or four” wells in the Midland, Barnett and Woodford. Diamondback’s spending is flat in 2023 after a 31% increase in 2022 as it absorbed its acquisitions of FireBird Energy and Lario Petroleum. It is guiding to flat production as it targets $500 million to $1 billion in non-core asset sales.

EOG Resources, in turn, increased its 2023 Permian spending by 13% to $3.5 billion, the third-largest total in the play, but its goal is to keep activity and output relatively flat. The bulk of its total 30% increase in 2023 investment is targeted to exploration and appraisal activity in its recently unveiled unconventional plays in other basins. Devon Energy’s $2.1 billion in planned 2023 Permian capex, a 16% increase, represents 60% of its total investment and includes approximately $200 million for delineating upside opportunities in the deeper Wolfcamp formation in the Delaware Basin. Matador Resources has guided to the largest capex increase on a percentage basis: a 51% boost to $1.12 billion, following its $1.6 billion acquisition of Advance Energy Partners. On April 3, Ovintiv announced the $4.25 billion acquisition of Midland Basin acreage from three private producers that will double its Permian liquids production and double its capital spending in the play to an annual $1.4 billion after the anticipated mid-year 2023 closing of the purchase.

Capital spending by our 42 E&Ps in the Eagle Ford Shale is scheduled to increase by a hefty 32% to $7.35 billion, which accounts for 10% of their total 2023 investment, up from 9% in 2022. The increasing activity in the play is reflected in EIA data, which shows total production increased 15% between December 2021 and March 2023. EOG Resources is hiking investment in the South Texas play by 64% from $1.1 billion to $1.8 billion, telling analysts, “After a decade of stellar operational improvements in the Eagle Ford, it has become a highly efficient, high-margin play with existing infrastructure and access to favorable markets.” EOG’s spending includes a “moderate increase” in activity in its new Dorado gas play, where it will complete about 10 additional wells versus last year.

Devon Energy is more than doubling capex in the Eagle Ford from $271 million to $700 million after the $1.8 billion acquisition of Validus Energy that doubled its acreage and production in the play. Devon is stepping up to become an Eagle Ford operator — its previous holdings were a 50% non-operated joint venture with BP’s BPX Energy. The $3 billion acquisition of Ensign Natural Resources has triggered a 37% investment boost to $780 million by Marathon Oil, which will run a four-rig program in South Texas. ConocoPhillips, the second-largest Eagle Ford investor, is budgeting a modest 13% increase to $1.58 billion that maintains its second-half 2022 activity level there. The sole producer shifting some investment away from the play is SM Energy, which is moving from a 50/50 split between the Eagle Ford and its Permian acreage to 60% Midland spending because of lower prices for its gas-weighted South Texas output.

The oil and gas producers we track are increasing capital investment in the Bakken Shale by 36% to $6 billion, the largest percentage increase among U.S. unconventional resource plays. In contrast to the Permian and Eagle Ford, total production from the play has been relatively flat since late 2021, but higher oil prices are apparently spurring a resurgence in activity. Continental Resources, which was taken private by founder Harold Hamm in November 2022, is increasing its investment in the play by 66% to $1.33 billion, although it has not disclosed specific drilling plans. Hess Corp. is raising investment by 26% to $1.1 billion to boost free cash flow from the Bakken that helps fund the substantial capital to develop its massive ExxonMobil-operated oil discoveries offshore Guyana. Marathon Oil’s 2023 budget in western North Dakota is up 41% as the company highlights the profitability of a play where the average well pays off in six months at current commodity prices. Chord Energy, formed by the merger of Oasis Petroleum and Whiting Petroleum, has set a 33% increase in investment that reflects modest oil output growth after accounting for inflation. Enerplus, which has been moving toward becoming a pure Bakken producer, is allocating 95% of its total $525 million budget to the play after divesting its remaining Canadian assets late last year. The company expects 3%-5% liquids output growth. Northern Oil & Gas, which exclusively holds non-operated interests, said its 2023 capital expenditures in the Bakken will jump from $172 million to $417 million because of increased activity by the operators of the wells in which it owns an interest.

E&P capital spending in the Rocky Mountain region is forecast to rise 26% to $4.3 billion, which represents 6% of total outlays. A key factor in the increase is that major DJ Basin producers have adapted to a new, stricter permitting regime instituted by the state of Colorado that interrupted well planning. PDC Energy said in its year-end conference call that it had “cracked the code on obtaining permits in the state of Colorado,” having approvals in hand for its entire 2023 program. The company is raising investment 23% to $1.14 billion, or 80% of its total capex, as it shifts focus away from its Permian position. Occidental Petroleum said it is “beginning to see additional progress in Colorado’s new permit-approval process,” which paved the way for completion of more than 200 wells in Weld County over the next few years. Oxy is also raising capex by 23% to $750 million. In stark contrast, Civitas Resources, which was created by the merger of pure DJ Basin producers Bonanza Creek Energy, Extraction Oil & Gas, Crestone Peak Energy, and Bison Oil & Gas, is cutting investment by 15% as it institutes a generous new shareholder-return program that includes a fixed and variable dividend expected to pay $600 million in dividends in 2023, about 60% of free cash flow.

EOG Resources is doubling its Rockies investment to $528 million as it plans 20 completions on its new Powder River Basin play in addition to continuing DJ Basin development. Continental Resources is budgeting nearly $200 million for its newly acquired Powder River position. Ovintiv is nearly tripling spending on its Uinta Basin assets, which it says “match the Permian for the highest operating margin in our portfolio.” Denbury Resources is spending $360 million to complete its EOR project in Wyoming’s Cedar Creek Anticline, which it estimates will add 400 million barrels of recoverable oil.

In contrast with the more expansive spending in the oil-weighted plays, Marcellus and Utica shale producers are guiding to a 9% increase in 2023 investment to $7 billion, which represents 10% of total U.S. capex for the E&Ps we track. Appalachian E&P spending soared 57% from 2021 to 2022 on generous natural gas prices, but the subsequent plunge in realizations along with looming outbound pipeline capacity constraints has led to a sharp reduction in planned activity in the upcoming year. A 39% increase in investment by EQT, the largest U.S. gas producer, accounts for almost the entire boost in Marcellus/Utica capex. The company said the higher budget largely reflects delays in the start-up of 30 wells from 2022 to 2023 due to third-party constraints. The company said the “catch-up capital” associated with this is non-recurring and that investment will decline in 2024.

Chesapeake Energy is budgeting a steep reduction in Appalachian investment from $750 million to $455 million. The company is dropping one rig and is “reducing our completion activity in the near-term as the market is currently oversupplied after a warm winter in North America.” The result will be a 2% decline in production. Coterra Energy, formed from the merger of Marcellus producer Cabot Oil & Gas with Permian and Anadarko Basin E&P Cimarex Energy, is raising Marcellus investment by approximately 16% to cover 10% inflation plus the additional costs of longer laterals. It expects output to be flat to slightly down. Antero Resources is guiding to a similar increase to $900 million that it describes as “maintenance-level spending.” Southwestern Energy is keeping investment flat at $890 million by dropping a rig, which will lower production by 2%-3%. Range Resources, CNX Resources, and National Fuel Gas are also targeting level expenditures.

Low natural gas prices have resulted in a pullback in activity in the play by the three major Haynesville producers we cover: Comstock Resources, Chesapeake Energy, and Southwestern Energy. Capital expenditures in 2023 are estimated at $3.1 billion, 4% higher than in 2022 because of the impact of 10% inflation, but that investment reflects a lower level of activity. Chesapeake Energy is dropping two rigs in the play and reducing completion activity in the near-term, which it anticipates will result in a 2% production decline. “As far as non-operated rigs, we are starting to see some signs of operators pulling back activity in the Haynesville,” the company said. “It’s been primarily showing up with the privates to date.” Comstock Resources is releasing two of its nine rigs in 2023 in response to lower gas prices while setting its 2023 capex at $1.03 billion, flat from the previous year. Southwestern Energy is also keeping its investment flat at $1.2 billion, cutting one rig on average versus 2022. The company expects a 2%-3% decline in production.

Elsewhere in the U.S., capital spending in the U.S. Gulf of Mexico is expected to increase 15% to $2.1 billion as Occidental Petroleum, Murphy Oil, and Hess Corp. modestly boost activity in the play. SCOOP/STACK investment will rise 11% to $1.8 billion as a $350 million increase by Continental Resources more than offsets lower or flat spending by other public U.S. producers in the gas-weighted resources play.

International spending by U.S. E&Ps is expected to fall slightly from $6.2 billion in 2022 to $6 billion in 2023. Development of its Guyana discoveries will boost Hess Corp.’s investment by $400 million to $2.2 billion, but that is more than offset by a $470 million reduction in international spending by ConocoPhillips. Ovintiv’s Canadian investment in the Montney Shale will nearly double from $300 million to $550 million, but APA Corp.’s capex in Egypt and the North Sea will fall by nearly the same amount. Occidental Petroleum’s capital allocation to its Equatorial Guinea and Middle East ventures will remain flat at $500 million.

Looking forward, continuing low natural gas prices from a much-warmer-than-average winter have been reflected in cautious statements by gas producers that portend additional budget cuts. Some oil producers, on the other hand, indicate potential movement of rigs released in gas plays to oil-weighted resources, easing inflation. We’ll closely analyze the upcoming Q1 reports of the companies we follow to report on any significant changes in capital allocation.

“Ebb and Flow” was written by Larry and His Flask and appears as the seventh song on Larry and His Flask’s fourth studio album, All That We Know. The title of the album is taken from the chorus of the song which deals with life, death, grieving and acceptance: “Ebb and flow, is life and death still all that we know?” The band was known to have tagged the outro chorus in live renditions with John Lennon’s “Imagine.” Personnel on the record were: Andrew Carew (banjo, backing vocals), Ian Cook (lead vocals, guitar), Jeshua Marshall (acoustic bass, backing vocals), Jamin Marshall (drums, backing vocals), Dallin Bulkley (guitar, backing vocals), and Kirk Skatvolk (mandolin, backing vocals).

All That We Know was the 14-song LP Larry and His Flask released on the Silver Sprocket Bicycle Club label in June 2011. The band toured extensively during 2011, including playing at the Warped Tour, to support the album.

Larry and His Flask are a self-styled “post-American rock band” formed in Bend, OR, in 2003. They have been described as representing folk/bluegrass music in the same manner that Flogging Molly represents traditional Irish folk music. Live, the band presents an audience-interactive show similar to Gogol Bordello, with a kindred genre-bending approach to their music. They have released six studio albums and two EPs. Ten people have passed through the band since its inception. Brothers and founding members Jeshua and Jamin Marshall are the only current members of the group. They still occasionally perform live. Jeshua Marshall will begin a European tour with Danny Attack beginning in June 2023.

"flow" - Google News

April 05, 2023 at 08:00AM

https://ift.tt/N9egjWf

Ebb and Flow - Commodity Pricing Currents Trigger Significant Regional Shifts in 2023 E&P Investment - RBN Energy

"flow" - Google News

https://ift.tt/p9LdQXz

https://ift.tt/IEDQj6c

Bagikan Berita Ini

0 Response to "Ebb and Flow - Commodity Pricing Currents Trigger Significant Regional Shifts in 2023 E&P Investment - RBN Energy"

Post a Comment