ogichobanov

Investment Thesis: Dividend Covered By Free Cash Flow

Leggett & Platt Inc. (NYSE:LEG) is an industrial company that manufactures component parts for a variety of product types from mattresses to vehicle seats to flooring and furniture. It is also a Dividend King by right of its 51 consecutive year dividend growth record.

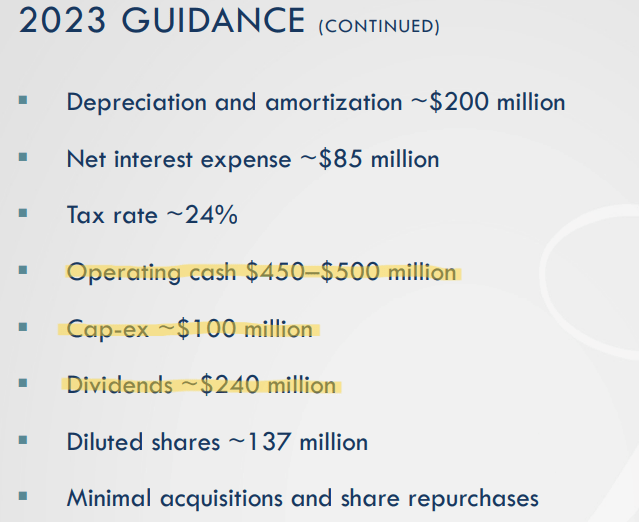

Investors seem to be worried about the sustainability of LEG's 5.7%-yielding dividend, because the annualized $1.76 in dividends per share is higher than the midpoint of 2023 earnings per share guidance of $1.50 to $1.90. But EPS includes a few significant non-cash expenses like amortization and depreciation. Management has guided for ~$200 million in amortization & depreciation in 2023, up 11% from 2022's ~$180 million.

To assess dividend safety, it's better to look at free cash flow. And when it comes to FCF, the dividend looks very safe. In fact, compared to 2022's $344 million in FCF, management expects FCF to rebound to $350 million to $400 million in 2023.

LEG March Presentation

Compared to 2022's 69% FCF payout ratio, this guidance foresees a 2023 FCF payout ratio in the range of 60-69%. This is roughly in line with LEG's historical FCF payout ratio range.

Moreover, given LEG's pullback in spending on acquisitions and share repurchases this year gives me confidence that the company's cash management practices are disciplined and conservative.

LEG's dividend appears to be safe, and right now looks like an ideal time to be accumulating shares of this high-quality industrial Dividend King.

What Makes Leggett & Platt A High-Quality Company

In a recent exclusive article for High Yield Landlord, I talked about how exactly to define "quality" when it comes to a business and laid out a number of characteristics of a high-quality company.

LEG fits with all of the quality characteristics I identified:

| Quality Characteristic | Leggett & Platt |

| Provides essential goods and/or services to its customers | Though end products are mostly discretionary, LEG's products are essential to those discretionary goods |

| Tangible and/or intangible competitive advantages | Long-established customer relationships; few major competitors |

| Pricing power and unit volume growth | Pricing power from a focus on quality; unit volume growth from internal initiatives plus acquisitions |

| Strong market positioning in a secular growth trend | #1 or #2 market share in almost all product segments; upside from a rebounding housing market and return to GDP growth |

| High returns on invested capital (well in excess of cost of capital) | Average of 16% ROIC over the last 10 years |

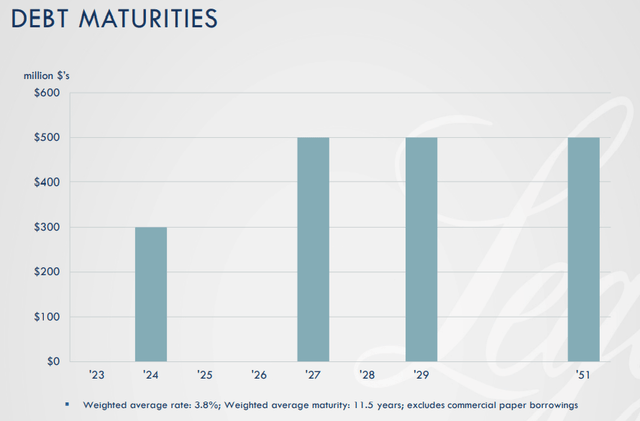

| A strong balance sheet that remains resilient across the full economic cycle | BBB credit rating; long-term debt to enterprise value of 35%; net debt to EBITDA of 2.7x; no significant maturities until November 2024 |

| A skilled and shareholder-aligned management with a solid track record | Long-tenured management; significant stock ownership; sometimes forego cash comp in exchange for common stock; incentives focused on total returns |

| A safe and growing dividend | Safely covered by FCF; 51-year dividend growth streak |

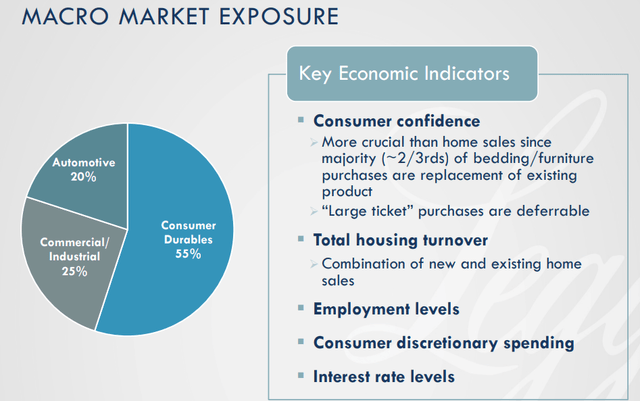

LEG is a business-to-business company rather than a business-to-consumer company. That makes its overwhelming exposure to discretionary end products a little less cyclical, although the company's sales are still prone to swings associated with housing and economic cycles.

LEG March Presentation

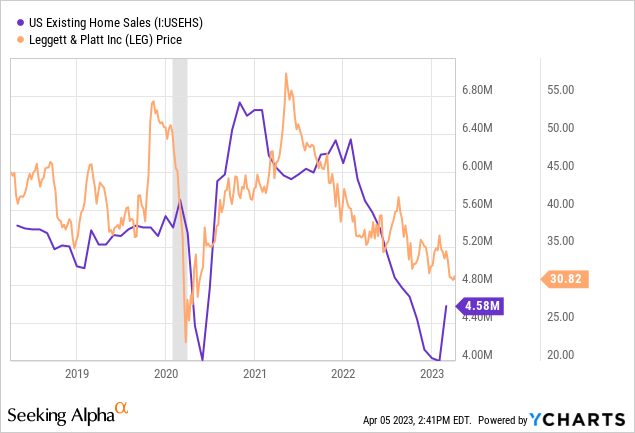

Given LEG's strong market positioning in bedding, furniture, and flooring, one of the biggest drivers of its fundamental performance is the housing market, specifically home sales volume. Home sales tend to correlate with furniture and flooring sales, although LEG does assert that ~2/3rds of bedding and furniture purchases are replacements.

The association of buying a home with bed, furniture, and flooring purchases is why LEG's stock price follows home sales volume so closely.

About 2/3rds of LEG's sales come from the US with the remainder elsewhere. So, the American housing market plays a huge role in LEG's performance, and more broadly we might state that LEG is correlated with GDP growth.

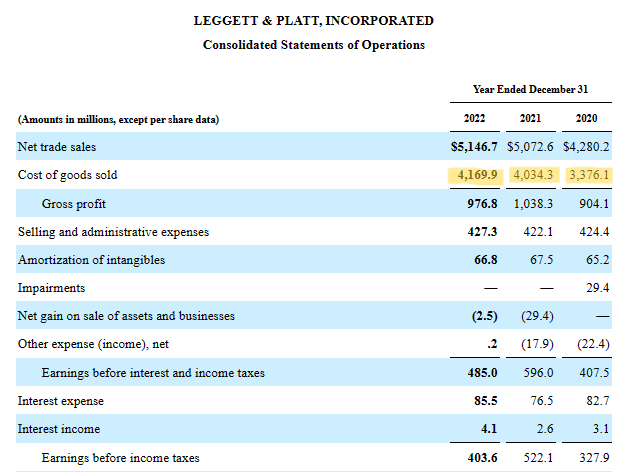

Thus, as GDP surged from 2020 to 2022, so also did LEG's sales. Unfortunately, though, due to soaring commodity prices starting in 2021, LEG's input costs (i.e. cost of goods sold) also spiked.

LEG 2022 10-K

From 2020 to 2022, LEG's net sales grew 20.2%, while cost of goods sold increased 23.5%. The good news, though, is that management sees input costs falling meaningfully in 2023 (and probably beyond). While materials (~60% of COGS) prices like steel and cotton are expected to fall, LEG's newly hiked product prices are here to stay, which should restore the company's margins and perhaps even expand them from where they were pre-pandemic.

Notably, LEG's 2023 guidance for interest expenses of ~$85 million are basically flat against 2022's $85.5 million. That's fantastic to see in an era where most companies' interest costs are soaring this year.

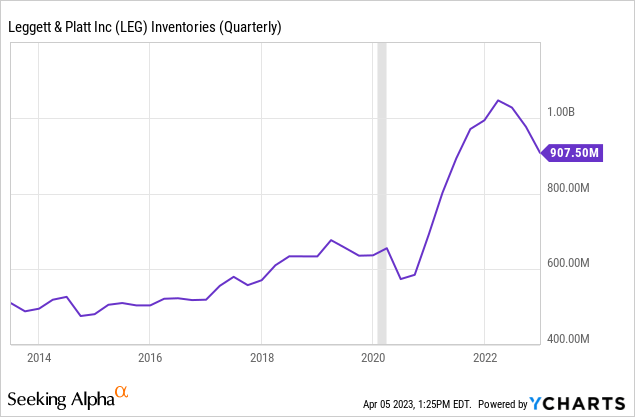

Another positive point to note is that, after a big inventory buildup in 2021, LEG's inventory levels have been falling over the last several quarters.

For multiple reasons, having too high of an inventory is generally bad for business, so seeing it decline indicates that LEG can sell what it has already paid to produce instead of spending the money to produce more goods.

When it comes to the balance sheet, LEG earns its investment grade, BBB credit rating with widely spaced debt maturities with a weighted average maturity of 11.5 years.

LEG March Presentation

The next maturity isn't until November 2024, and after that, nothing matures until 2027.

Long-term debt of $2.074 billion at the end of 2022 jumped by about 16% YoY from 2021's $1.79 billion.

That said, LEG ended 2022 with $316.5 million in cash (7.7% of current market cap) as well as ~$1.2 billion available on its credit facility, giving the company ample liquidity with which to navigate whatever the market throws at it this year.

Bottom Line

LEG is in the middle of a cyclical low in its business lines. That does not mean the quality or long-term growth prospects of the company have eroded. The riskiness of cyclical companies always looks higher during the trough part of the cycle, but every cycle has both its ups and its downs.

What you want to see with a dividend growth company involved in cyclical product lines is strong capital allocation and cash management that prepares for the cyclically weak periods during the cyclically strong periods. I think that is exactly what we see with LEG.

Moreover, over 1/3rd of management's stock compensation is tied to FCF and ROIC metrics, which incentivizes them to allocate capital prudently and manage the business to generate ample cash flow.

Between LEG's 5.7% dividend yield and mid-single-digit profit growth over time, the company should produce total returns of at least 10% from here even assuming no valuation upside. But I think the stock also has 30-35% upside to full-cycle fair value.

"flow" - Google News

April 06, 2023 at 07:30PM

https://ift.tt/6vzAdlE

Leggett & Platt Stock: Look At Cash Flow Instead Of Earnings (NYSE:LEG) - Seeking Alpha

"flow" - Google News

https://ift.tt/p9LdQXz

https://ift.tt/IEDQj6c

Bagikan Berita Ini

0 Response to "Leggett & Platt Stock: Look At Cash Flow Instead Of Earnings (NYSE:LEG) - Seeking Alpha"

Post a Comment