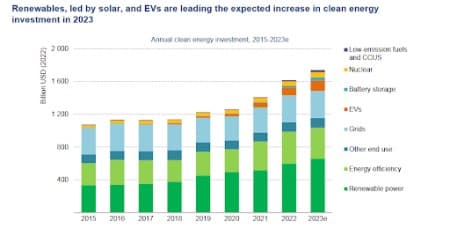

- According to Fatih Birol, the IEA’s executive director, solar investments are expected to attract over $1 billion a day in 2023.

- Since the energy crisis hit two years ago, many of the world’s governments have doubled down on renewable energy since they view the sector as an ideal way to not only decarbonize but also achieve energy security.

- Several oil producing hubs including Saudi Arabia and UAE are investing heavily in renewable energy as they try to diversify their economies.

The amount of capital investment flowing into the solar sector is poised to overtake the amount of investment going into oil production for the first time ever in 2023, the International Energy Association has reported.

According to Fatih Birol, the IEA’s executive director, solar investments are expected to attract over $1 billion a day in 2023 with over $1.7 trillion slated to flow clean energy technologies such as EVs, renewables and storage. Overall, global investment in energy is projected to hit ~$2.8 trillion in the current year.

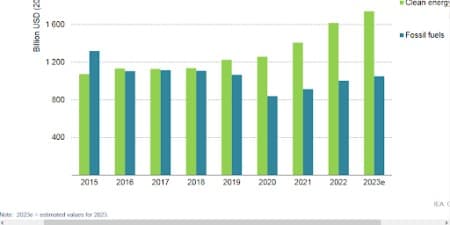

Speaking to CNBC’s Arabile Gumede on Thursday, Birol said there was a “growing gap between the investment in fossil energy and investment [in] clean energy. Clean energy is moving fast--faster than many people realize. This is clear in the investment trends, where clean technologies are pulling away from fossil fuels. For every dollar invested in fossil fuels, about 1.7 dollars are now going into clean energy.”

Since the energy crisis hit two years ago, many of the world’s governments have doubled down on renewable energy since they view the sector as an ideal way to not only decarbonize but also achieve energy security. Further, several oil producing hubs including Saudi Arabia and UAE are investing heavily in renewable energy as they try to diversify their economies.

Global energy investment in clean energy and in fossil fuels, 2015-2023e

Source: IEA

Cheaper than oil and gas

Another big reason why the clean energy sector is growing fast is due to the fact that after many decades, renewable energy is finally competitive with fossil fuels in electricity generation.

Last year, Energy Intelligence’s senior reporter Philippe Roos analyzed the cost of generating electricity, also known as levelized cost of energy (LCOE), of conventional and renewable forms of electricity generation in five regions: the U.S., Western Europe, Japan, the Mideast and developing Asia. The data, which also include break-even prices for oil, gas and coal in the Mideast and developing Asia, was based on Energy Intelligence’s proprietary LCOE model.

The EI study revealed that renewables had overtaken gas permanently on cost-effectiveness, with the race for lowest cost remaining mostly between solar photovoltaic (PV) and onshore wind. This trend rings true even in Japan, where the scarcity of real estate handicaps land-intensive renewables, onshore wind beats coal and PV displaces gas.

|

REGIONAL NEWBUILD POWER GENERATION COSTS |

|||||

|

($/MWh) |

United States |

Europe |

Japan |

Dvlpg. Asia |

Middle East |

|

Large Solar PV |

36.6 |

69.6 |

116.6 |

36.6 |

32.3 |

|

Onshore Wind |

40.9 |

54.1 |

83.3 |

46.9 |

60.7 |

|

Gas CCGT |

52.4 |

200.5 |

183.8 |

169.8 |

167.5 |

|

Large Hydro |

57.9 |

75.7 |

78.0 |

46.6 |

92.5 |

|

Coal |

73.2 |

182.3 |

94.2 |

64.6 |

123.8 |

|

Geothermal |

84.8 |

84.8 |

126.9 |

38.0 |

163.0 |

|

Gas OCGT |

94.7 |

316.9 |

284.4 |

272.0 |

267.1 |

|

Offshore Wind |

95.1 |

191.9 |

191.9 |

109.8 |

101.7 |

|

Nuclear |

104.1 |

104.1 |

118.4 |

57.8 |

86.6 |

|

Solar CSP |

115.6 |

176.0 |

NA |

187.8 |

114.8 |

|

Biomass |

131.8 |

131.8 |

131.9 |

107.6 |

125.4 |

|

Coal with CCS |

142.1 |

211.0 |

192.4 |

134.5 |

225.5 |

|

Wave-Tidal |

274.4 |

274.4 |

268.5 |

260.2 |

260.0 |

Legend:

CCGT: combined-cycle gas turbines

OCGT: open-cycle gas-turbine

CSP: concentrated solar power

According to the LCOE report, “wind and PV generation costs remain lower than fossil fuel alternatives, especially with current high gas and coal prices”, and with supply chain issues troubling both sectors equally, renewable technologies are still the cheapest.

A possible exception to this trend later this year is natural gas since gas prices have fallen so dramatically over the past couple of months.

After hitting multi-decade highs shortly after Russia invaded Ukraine, natural gas prices in Europe have declined sharply with prices on course to drop by as much as 15% this week alone. Prices have now crashed 90% since the August 2022 record-high of over $322 (300 euros) per MWh with weak industrial demand and high inventories for this time of the year the main reasons.

In contrast, oil and coal prices remain well above their 5-year averages. With OPEC+ willing to go to great lengths to keep prices high and U.S. shale drillers unwilling or unable to rapidly ramp-up production, oil markets are likely to remain relatively tight at least in the medium term.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

Alex Kimani

Alex Kimani is a veteran finance writer, investor, engineer and researcher for Safehaven.com.

More Info"flow" - Google News

May 29, 2023 at 04:00AM

https://ift.tt/AQpvC8u

More Money Will Flow Into Solar Than Oil For The First Time - OilPrice.com

"flow" - Google News

https://ift.tt/zkAUyBh

https://ift.tt/L9BZj5K

Bagikan Berita Ini

0 Response to "More Money Will Flow Into Solar Than Oil For The First Time - OilPrice.com"

Post a Comment