constantgardener/iStock via Getty Images

Introduction

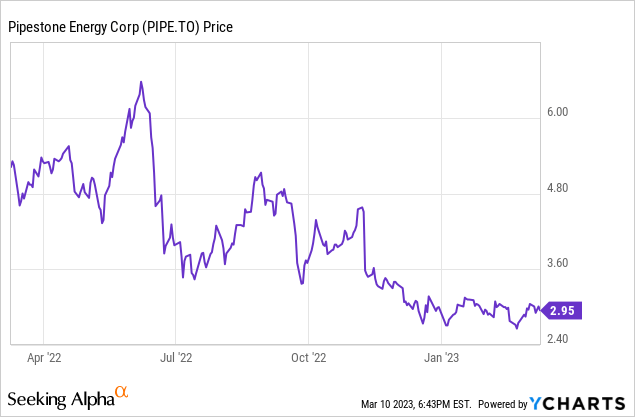

Pipestone Energy (TSX:PIPE:CA) (OTCPK:BKBEF) has been on my radar for the past year and although the natural gas price collapsed in the past few quarters, the company's share price only saw (relatively) moderate decreases as about 30% of the oil-equivalent production rate consists of condensate, a highly sought after product in Canada which is used by oil sands operators as a diluent. Thanks to those fundamentals, condensate often trades at a premium to the WTI price and this will be very helpful for Pipestone in the next few quarters. The company has now provided a revised forecast using more conservative inputs, and the stock is still relatively attractive from this point of view.

2023 started weak as the natural gas price has been pretty disappointing so far

Seeing a weaker natural gas price after a very strong 2022 was not unexpected but I was surprised to see the AECO natgas price drop below C$3. The average price in February for instance was just over C$2.50, and although March is starting well with an average price of over C$3 in the first ten days of the month, it's clear Pipestone's original guidance using an AECO price of C$4 throughout the year had to be toned down.

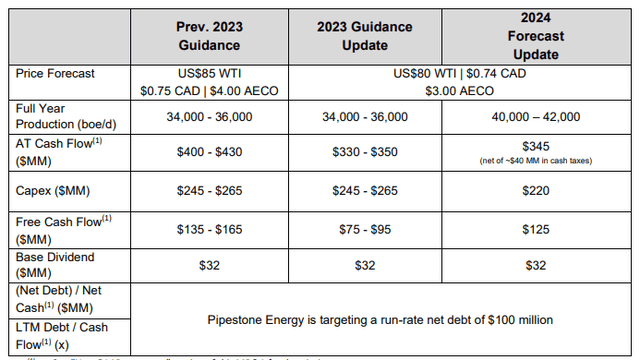

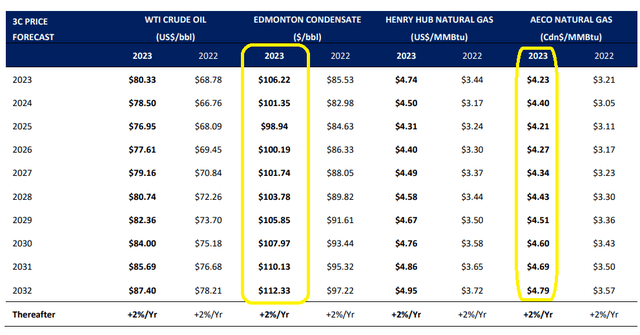

Pipestone released an updated guidance for both 2023 and 2024. The production rate for 2023 hasn't changed and the capex numbers also remained unchanged. But the adjusted funds from operations has now been updated using a WTI price of US$80/barrel and an AECO natural gas price of C$3 (versus US$85 and C$4 respectively). One could argue this is perhaps a bit too conservative now (as Pipestone still has some hedges at C$7.62 in Q1 2023 which will mitigate the impact of the lower market prices and also keep in mind Pipestone sells some of its natural gas using Chicago Citygate prices which are currently about 10% higher than the AECO prices but require a higher transportation cost) but I understand Pipestone's approach and it's easier to provide a positive revision later this year than having to cut a second time.

Pipestone Energy Investor Relations

Despite the lower prices, Pipestone's cash flows remain attractive. Based on the new assumptions, the company will generate C$75-95M in free cash flow this year, which will increase to C$125M next year as the capex will go down and the growth capex spent in 2022 and 2023 will result in an additional 15%-20% production increase.

There are currently 279M shares outstanding which means the FCFPS (including growth investments) will be C$0.30 per share this year, increasing to C$0.45 next year. While this doesn't make Pipestone cheap from an optical point of view, keep in mind this includes investments in additional production growth.

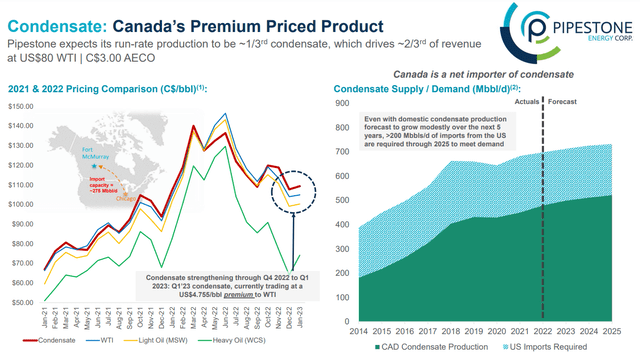

Let's also take a moment to discuss the dynamics on the condensate market. Condensate is used by oil sands operators as a diluent for their heavy oil products. There's only one small issue: Canada does not produce enough condensate and has to import more condensate from the United States. That's why there always will be a demand for Pipestone's condensate products and that also explains why condensate is trading at a small premium to WTI: It's easier for Alberta-based oil sands producers to use a nearby source of condensate rather than shipping it all the way from the US.

Pipestone Energy Investor Relations

During Q4 2022, the average condensate price was approximately C$3.20 per barrel higher than the WTI oil price. And during the first two months of 2023, the gap widened as Pipestone's management confirmed a premium of C$3-6/barrel.

Thanks to the robust free cash flow this year, Pipestone Energy should be able to meet its C$100M net debt target. Depending on fluctuations in the working capital position and the capex timing, it's not unrealistic to expect this target to be reached by the end of Q1 or perhaps shortly after.

That also would mean there will be more room to hike the dividend. Pipestone is currently budgeting C$32M per year for dividends for a payout ratio of approximately 25% of next year's free cash flow at C$3 AECO. The current quarterly dividend is C$0.03 resulting in a yield of just over 4% which is a decent compensation while waiting for the natural gas price to improve.

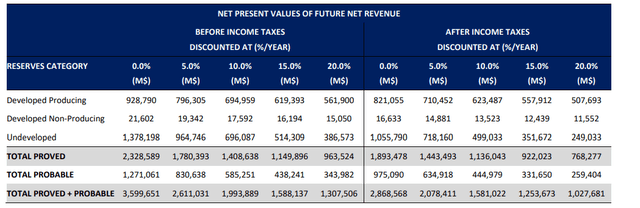

Another element I like about Pipestone is the value of its reserves. The after-tax PV10% of the current 2P reserves is C$1.58B, and using a discount rate of 15%, the value would still be C$1.25B.

Pipestone Energy Investor Relations

After deducting the C$100M in net debt, the NAV of the after-tax PV10 is approximately C$1.48B which is C$5.30 per share. One could argue the consultants used a more optimistic natural gas price than Pipestone is using now (but a lower condensate price) but even if you would discount the cash flows by 15% the NAV/share would still be north of C$4.

Pipestone Energy Investor Relations

Investment thesis

I have been building a long position in Pipestone Energy but I'm in no rush. I'm happy to see the net debt decrease and while the FCF guidance is a bit light due to the lower natural gas and condensate prices, keep in mind the capex guidance includes investments in growth which should result in a 15-20% production increase in 2024 vs. the anticipated 2023 production rate.

Pipestone is doing all the right things. 2023 may be tough, but even at C$3 AECO, 2024 should be substantially better with an anticipated free cash flow (including growth capex) of almost C$0.45/share. Pipestone will launch a Substantial Issuer Bid in 2023 where it will offer shareholders to repurchase shares at a premium to the market price.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

"flow" - Google News

March 11, 2023 at 11:35PM

https://ift.tt/v7Sabo3

Pipestone Energy: Strong Cash Flow Projections Even At C$3 Natural Gas (OTCMKTS:BKBEF) - Seeking Alpha

"flow" - Google News

https://ift.tt/8Wk7HC9

https://ift.tt/N3bc7sH

Bagikan Berita Ini

0 Response to "Pipestone Energy: Strong Cash Flow Projections Even At C$3 Natural Gas (OTCMKTS:BKBEF) - Seeking Alpha"

Post a Comment