Jian Fan

With tech stocks having rallied sharply since the start of the year, many investors are wondering if there are any true pockets of value left in the sector. In my view, there certainly are: investors just have to be willing to stomach some short-term volatility in order to buy into some truly great long-term assets at a very opportunistic price.

Pure Storage (NYSE:PSTG) falls squarely into this category. This flash storage leader, which has in recent years converted into a high-margin, value-added software business with rich profitability, has seen its share price decline more than 10% year-to-date, with losses accelerating after the company's recent Q4 earnings print. Investors are rightly concerned about the company's sharp growth deceleration, but in my view, the devaluation of the stock has gone too far.

Focus on the long term

I remain very bullish on Pure Storage. The company still continues to grow subscription revenue at a strong pace; it has a healthy base of ARR, and most importantly, the company throws off generous amounts of free cash flow. It is reinvesting its profits into shareholder returns, recently approving an additional $250 million in buybacks (worth roughly 3% of the company's outstanding market cap).

Here is my full long-term bull case for Pure Storage:

- Shifting into a subscription/services play, which will help drive multiples appreciation for Pure Storage. In Q4, despite macro headwinds, Pure Storage still grew subscription services at a 23% y/y pace. This kind of revenue stream is just what Wall Street prizes: a recurring, high-margin stream of revenue from repeat customers. Yet in spite of this, the market's valuation of Pure Storage still treats it like a commodity hardware play, even if its pro forma gross margin now resembles most SaaS stocks in the high 60s/low 70s.

- Industry recognition. Pure Storage has been named a leader in storage for eight consecutive years by Gartner, the most influential software industry ranking system. Customers choose Pure Storage for the combination of its broad platform, its modern cloud-first approach, and simplicity for installation, and an unintimidating pay-as-you-go pricing model.

- Huge TAM. Pure Storage estimates its TAM at $60+ billion, which means its current ~$2.5 billion revenue run rate is only ~4% penetrated into this overall market.

- Pay-for-consumption is a win-win for both Pure Storage and its customers. Pure-as-a-Service is priced based on usage, generally priced on a GiB/month basis. Outside of relatively low minimum commitments, this is a benefit for new customers because they can start out with Pure Storage for select workloads only, reducing the barriers to entry. For Pure Storage, it's an advantage because, over time, these customers can expand to become major clients.

- Enterprise focus is growing. More to the point above, more than 50% of Pure Storage's revenue is now coming from enterprise clients, and the top 10 customers spend more than $100 million annually.

- Cash flow. Pure Storage is delivering huge cash flow, but with FCF margins in the mid-single-digits versus a low-teens pro forma operating margin, there's still plenty of room for expansion.

The bottom line here: Pure Storage may be experiencing some macro-driven headwinds in the moment, but I think the stock's rout leaves valuation in a very opportunistic spot.

Low valuation makes up for conservative guidance

Let's address the elephant in the room: Pure Storage stock sunk after its Q4 release owing to the company's expectations of reverting to single-digit revenue growth in FY24 (the year for Pure Storage ending in January 2024):

Pure Storage FY24 outlook (Pure Storage Q4 earnings deck)

Note that in the first half of FY23, Pure Storage had grown at a >30% y/y clip - so certainly, the sharp decline is noticeable. But this being said, I do think Pure Storage's lowball valuation more than makes up for this macro-driven hit to performance.

At current share prices near $24, Pure Storage trades at a market cap of $7.27 billion. After we net off the $1.58 billion of cash and $574.5 million of debt on Pure Storage's most recent balance sheet, the company's resulting enterprise value is $6.27 billion.

The best way to look at Pure's valuation, in my view, is against its rich FCF profile. In FY23, Pure Storage delivered $609 million in free cash flow. If we conservatively assume Pure Storage grows FCF by ~7% y/y in FY24 (in line with the company's revenue guidance of mid to high single-digit growth, and assuming margin maintains), FY24 FCF would be ~$652 million and Pure Storage's valuation stands at 9.6x EV/FY24 estimated FCF. Note that the assumption that margin holds is a very conservative one, given Pure Storage has been on an uptrend of boosting both gross and operating margins.

To me, this single-digit FCF multiple is too attractive to pass up.

Q4 download

Let's now review Pure Storage's latest Q4 results in greater detail. The Q4 earnings summary is shown below:

Pure Storage Q4 results (Pure Storage Q4 earnings deck)

Revenue grew 14% y/y to $810.2 million, in line with Wall Street's expectations but decelerating from Q3's 20% y/y growth pace (which, in turn, had decelerated from 30% y/y growth in Q2).

Management believes the slowdown is largely macro-driven, impacted by enterprise buying patterns. Per CEO Charles Giancarlo's remarks on the Q4 earnings call:

Since our Q2 earnings call, we have discussed seeing instances of longer sales cycles and caution with large purchases, especially in the enterprise segment.

As expected, these conditions continued through Q4 and close rates of our advanced stage deals continue to be consistent with the earlier quarters. While we were able to generate considerable new opportunities and pipeline during Q4, the development and progression of these new opportunities slowed substantially, especially in our enterprise segment. This recent slowdown in customers' purchasing expectations in conjunction with heightened concerns around further tightening monetary actions by the Fed and other central banks and governments, has impacted our growth outlook for the coming year.

We also believe that our successful sales motion over the last few years will need to adapt to the additional scrutiny that customers are now placing on purchases. We are, therefore, adjusting our sales motion for the additional economic analysis that customers need to justify purchases with tightened budgets. In particular, focusing our efforts on steps our customers can take to reduce their costs, both capital as well as operational while improving their human productivity. Evergreen One, FlashBlade//E and FlashArray//C will all play a large role in this new economy."

Storage, however, is a mission-critical service: and so even if companies are pulling back on IT spend in the near term to conserve cash in the midst of a recession, there is high hope for catch-up demand in the future.

Note as well that one bright spot is in international growth. While U.S. revenue grew only 6% y/y, reflecting domestic companies' sharp spending pullback, international revenue still grew at a healthy 39% y/y pace and contributed just under one-third of overall revenue.

And despite the growth crunch, Pure Storage's margin profile has remained quite healthy. Pro forma gross margins for the fourth quarter rose 200bps to 70.8%, reflecting economies of scale in the company's subscription services.

Pure Storage gross margins (Pure Storage Q4 earnings deck)

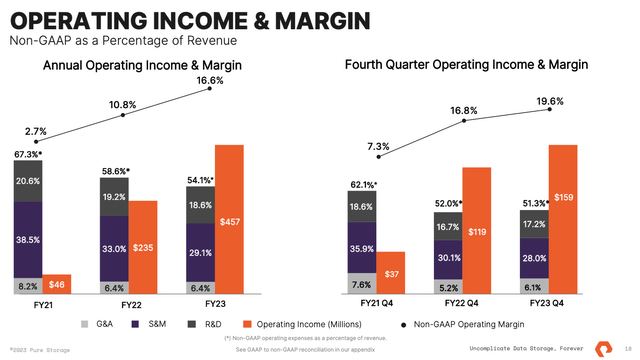

Pro forma operating margins also rose 260bps y/y to 19.6%:

Pure Storage operating margins (Pure Storage Q4 earnings deck)

Given Pure Storage's rich bottom-line performance, it's too early to discount the company's potential just yet.

Key takeaways

With rich cash flows, high gross margins, and a strong subscription business, I'm keen to load up on Pure Storage at <10x forward FCF. It may take several quarters to rebound, but I view Pure Storage at $24 as a very low-risk buying opportunity.

"flow" - Google News

March 04, 2023 at 09:48PM

https://ift.tt/MNs9VKr

Pure Storage: Buy The Dip And Focus On Cash Flow (NYSE:PSTG) - Seeking Alpha

"flow" - Google News

https://ift.tt/gbhKAjF

https://ift.tt/Jq18kaj

Bagikan Berita Ini

0 Response to "Pure Storage: Buy The Dip And Focus On Cash Flow (NYSE:PSTG) - Seeking Alpha"

Post a Comment