Qualcomm Incorporated QCOM recently announced a 7% year-over-year hike in its quarterly dividend payout to 80 cents per share or $3.20 on an annualized basis. The news seemed to have struck the right chords with investors as share prices rose 1.7% to close at $121.20 yesterday.

Based on the closing price, as of Mar 8, the proposed dividend affirms a yield of 2.6%. A steady dividend payout is part of the long-term strategy of Qualcomm to provide attractive risk-adjusted returns to its stockholders. In addition, healthy dividend increases at periodic intervals have been one of its strengths.

The current hike reflects the inherent financial strength of the company and the strong cash flow generated from continued focus on high-margin businesses and healthy execution of operating plans. Qualcomm generated $3,095 million of net cash from operating activities in first-quarter fiscal 2023 compared with $2,057 million a year ago. At quarter-end, the company had $4,808 million in cash and cash equivalents.

Qualcomm is one of the largest manufacturers of wireless chipsets based on baseband technology. The company is focusing on retaining its leadership in 5G, the chipset market and mobile connectivity with several technological achievements and innovative product launches.

The company is well-positioned to benefit from solid 5G traction with greater visibility and a diversified revenue stream to meet its long-term revenue targets. Qualcomm is witnessing strong demand in emerging product categories such as XR and wearables, along with 4G and 5G mobile broadband devices and rapid adoption of Wi-Fi 6. It is increasingly focusing on the seamless transition from a wireless communications firm for the mobile industry to a connected processor company for the intelligent edge. This augurs well for the long-term growth proposition of the company.

The buyout of Veoneer, Inc. offers Qualcomm a firmer footing in the emerging market of driver-assistance technology as it aims to extend the Snapdragon Ride Advanced Driver Assistance Systems (ADAS) portfolio. The Arriver business of Veoneer operates the dedicated software unit focused on sensor perception and drive policy, including a full stack of features and functions.

With the acquisition, Qualcomm has incorporated Arriver's Computer Vision, Drive Policy and Driver Assistance assets into its ADAS portfolio to deliver an open and competitive platform for automakers to better compete with rivals within the self-driving vehicle market. This, in turn, is likely to augment its automotive business as it strives to boost revenues beyond chipmaking for the smartphone market.

All these positive drivers and sound financial management probably led to the quarterly dividend hike.

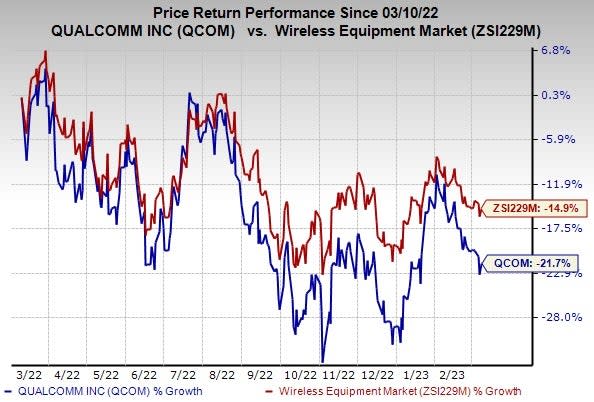

Shares of the company have lost 21.7% in the past year compared with the industry’s decline of 14.9%.

Image Source: Zacks Investment Research

Qualcomm presently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, sporting a Zacks Rank #1, is likely to benefit from the strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 17.5% and delivered an earnings surprise of 12.7%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Juniper Networks, Inc. JNPR carries a Zacks Rank #2 (Buy). It has a long-term earnings growth expectation of 7% and delivered an earnings surprise of 1.6%, on average, in the trailing four quarters.

Juniper is leveraging the 400-gig cycle to capture hyperscale switching opportunities inside the data center. The company is set to capitalize on the increasing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence.

Viavi Solutions Inc. VIAV, carrying a Zacks Rank #2, is another key pick. Headquartered in Scottsdale, AZ, Viavi is a leading provider of network test, monitoring and service enablement solutions to diverse sectors across the globe. The product portfolio of the company offers end-to-end network visibility and analytics that help build, test, certify, maintain, and optimize complex physical and virtual networks.

Viavi also offers high-performance thin film optical coatings for light-management solutions used in anti-counterfeiting, 3D sensing, electronics, automotive, defense and instrumentation markets. It delivered an earnings surprise of 9.1%, on average, in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Viavi Solutions Inc. (VIAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

"flow" - Google News

March 09, 2023 at 09:36PM

https://ift.tt/Ies1tGZ

Qualcomm (QCOM) Hikes Quarterly Dividend on Solid Cash Flow - Yahoo Finance

"flow" - Google News

https://ift.tt/8MaxetF

https://ift.tt/dLS0JUq

Bagikan Berita Ini

0 Response to "Qualcomm (QCOM) Hikes Quarterly Dividend on Solid Cash Flow - Yahoo Finance"

Post a Comment