Sign up for our coming Middle East newsletter and follow us @middleeast for news on the region.

An Abu Dhabi sovereign wealth fund may join a group investing in Saudi Aramco’s oil pipelines, in a deal set to be backed by a loan of around $10.5 billion.

Mubadala Investment Co., a fund with $232 billion of assets, is in talks with U.S. investor EIG Global Energy Partners LLC, the lead member of the consortium, according to a Mubadala spokesperson. A final agreement has yet to be reached, the spokesperson said.

Aramco has helped put together the loan, which the group will use to fund the transaction, according to people familiar with the matter. BNP Paribas SA, Citigroup Inc., HSBC Holdings Plc and Mizuho Financial Group Inc are among the lenders, according to the people. All four banks declined to comment.

Read: Aramco Selling $12.4 Billion Stake in Pipeline Rights Unit

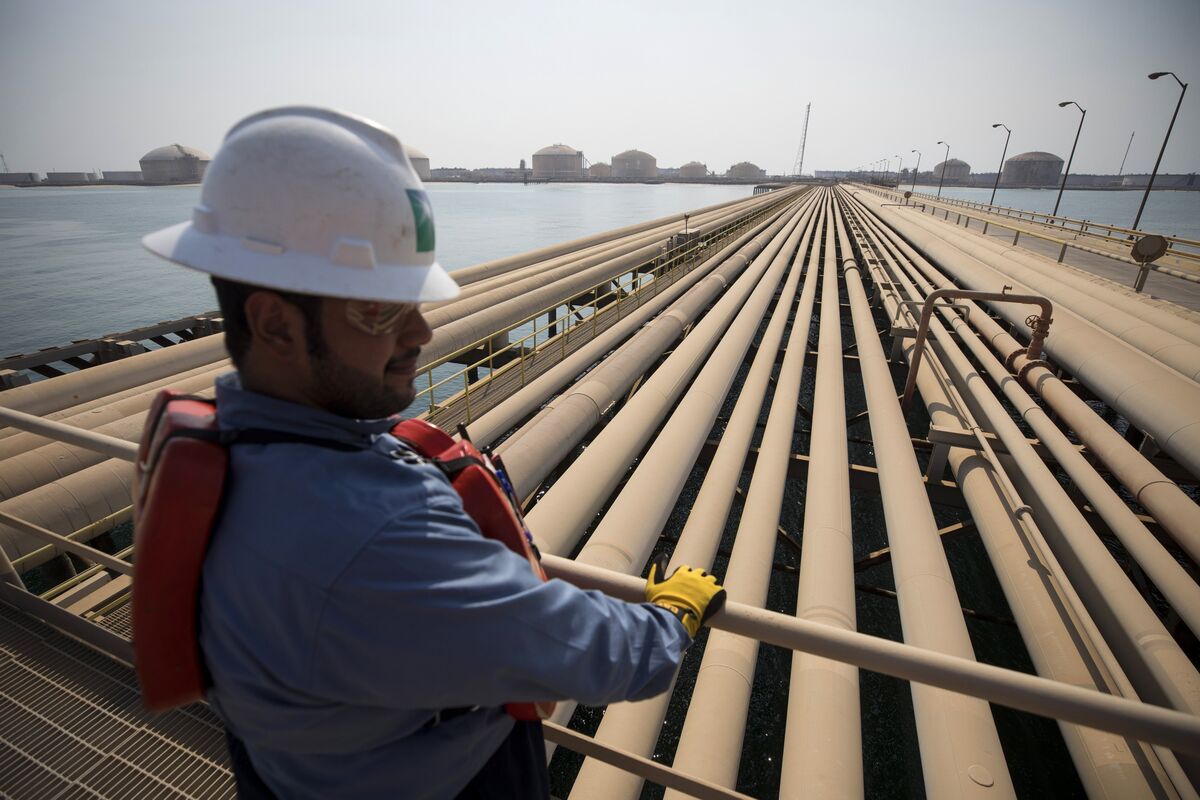

Washington-based EIG and Aramco, the world’s largest oil company, announced the $12.4 billion deal late Friday. The investors will buy 49% of Aramco Oil Pipelines Co., a recently-formed entity with rights to 25 years of tariff payments for crude shipped through the Saudi Arabian firm’s network. Aramco will own the rest of the shares and retain full ownership of the pipelines themselves.

The transaction is part of Saudi Arabia’s drive to open up more to foreign investment and use the money to diversify its economy, which was hammered last year by coronavirus lockdowns and the fall in oil prices.

Read: Saudi Crown Prince’s Past Makes His Vision a Tough Sell Abroad

The disposal may also help Aramco reduce its debt and maintain its dividend, the biggest of any listed firm globally. The company -- 98% owned by the Saudi government -- paid out $75 billion to shareholders last year.

The deal is structured similarly to one last year involving Abu Dhabi National Oil Co. In June, Adnoc raised $10.1 billion by selling leasing rights in its natural-gas pipelines to a group including Global Infrastructure Partners and Singapore’s sovereign wealth fund, GIC Pte.

East-West Pipeline

HSBC advised EIG on the Aramco acquisition, one of the largest this year in the energy sector. Apollo Global Management Inc., Brookfield Asset Management Inc. and BlackRock Inc. were among the other investors that made or considered bids.

Mubadala is the second-biggest wealth fund in the United Arab Emirates, of which Abu Dhabi is the capital.

The transaction covers all of Aramco’s existing and future pipelines in the kingdom, according to EIG. The company’s vast network includes the East-West Pipeline, which can carry more than 5 million barrels of crude a day from Saudi Arabia’s main fields in the east to Yanbu on the Red Sea.

EIG described it as a “lease and lease-back agreement.” Aramco will lease usage rights for its pipelines to the new subsidiary, which will then give Aramco the exclusive right to use the network for the 25-year period in exchange for a quarterly, volume-based tariff. Aramco will retain all operating and capital expense risk, EIG said.

— With assistance by Anthony Di Paola, and Shaji Mathew

"may" - Google News

April 11, 2021 at 04:09PM

https://ift.tt/2RmF8ax

UAE's Mubadala May Join $12 Billion Aramco Oil Pipeline Deal - Bloomberg

"may" - Google News

https://ift.tt/3foH8qu

https://ift.tt/2zNW3tO

Bagikan Berita Ini

0 Response to "UAE's Mubadala May Join $12 Billion Aramco Oil Pipeline Deal - Bloomberg"

Post a Comment