The top question on everyone’s mind when it comes to bitcoin is what the price will be in the next two to five years. Unfortunately, there is no universally accepted route to making such an assessment.

Some investors prefer a more fundamental approach, where they evaluate macro trends to identify future performance. Such variables could include the ongoing shift to electronic payments as well as inflationary spending by central banks in response to the economic destruction brought by the pandemic. Fundamental analysts also go to great lengths to assess an asset’s intrinsic value, meaning the properties that make it unique and valuable. A great deal of effort has been spent to define bitcoin’s intrinsic value, which is derived from a combination of its capped supply, network security, divisibility (bitcoin can be broken down to eight decimal points) and transportability.

Other investors, especially hedge funds take a more quantitative approach to investing. When using this route they care less about the intrinsic value of an asset and instead execute a trading strategy based on opportunities identified through the technical reading of price charts, because price movements represent pure demand, supply and of course investor sentiment and psychology. These investors use a variety of models and metrics to develop a strategy, and they often trade in and out of positions extremely quickly. Most rely on algorithms to automatically execute trades.

*- Excerpted from our premium research service Forbes CryptoAsset and Blockchain Advisor. Click here to subscribe

It Takes Two

That said, these approaches are not mutually exclusive, and many traders incorporate a combination of each in their strategies. Additionally, there are some technical models that require an element of fundamental analysis to make sense. An example is Stock-to-Flow (S2F), one of the most accurate price prediction models that we have seen in crypto to date.

Before getting into the details of S2F, it is important to clear up one common misconception. Although it was popularized in crypto by the pseudonymous PlanB, who described himself to me as a Dutchman in his 40’s with degrees in law and economics who has spent the last 25 years in traditional finance, he did not create S2F. Instead, because of bitcoin’s intrinsic value as a deflationary asset he applied the metric to create a price prediction model that ties the value of an asset to its current S2F ratio.

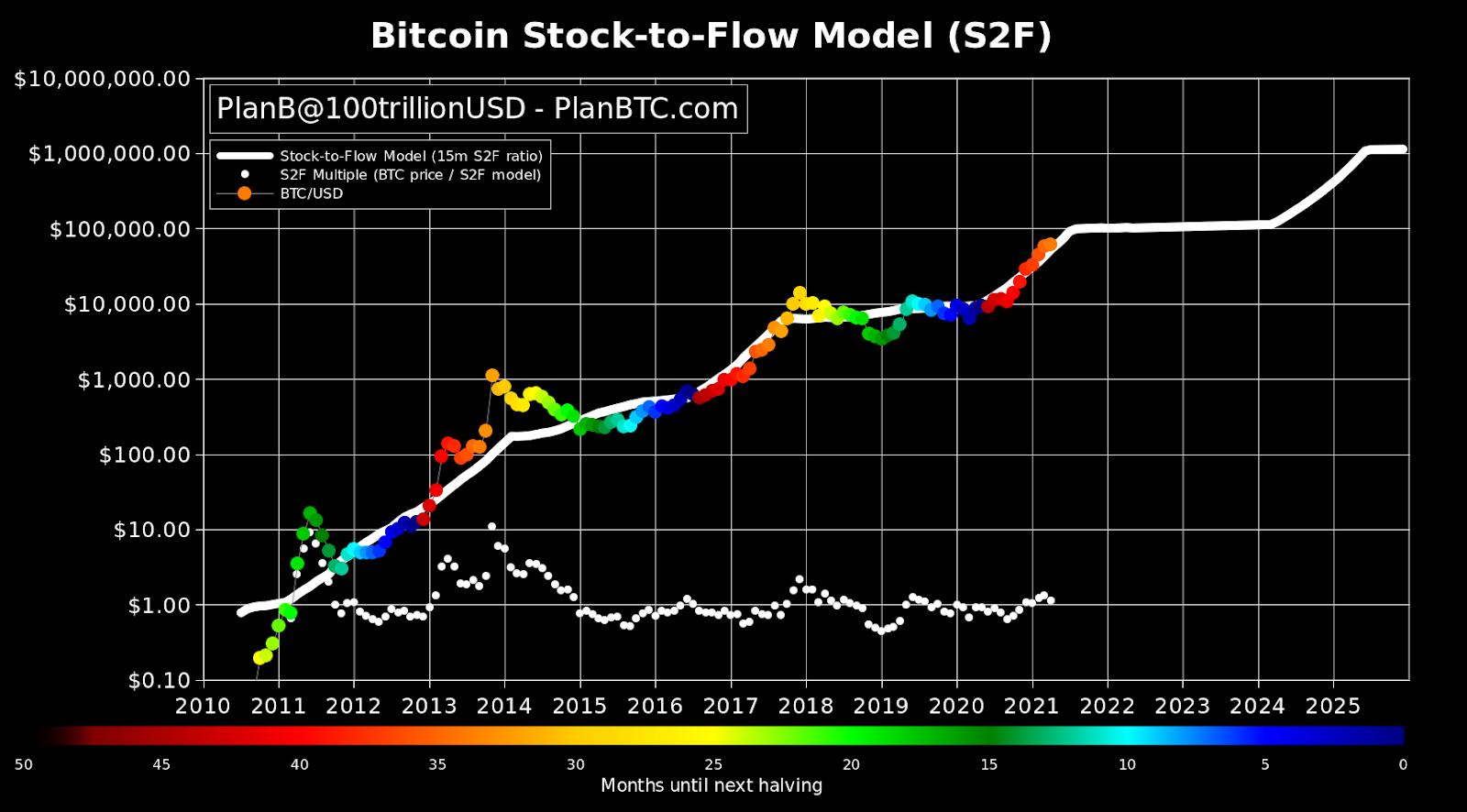

The results have been very compelling. In fact, S2F has probably been the most accurate tool that we have for predicting bitcoin’s price. See for yourself.

Bitcoin Stock-to-Flow Model

PlanBHow It Works

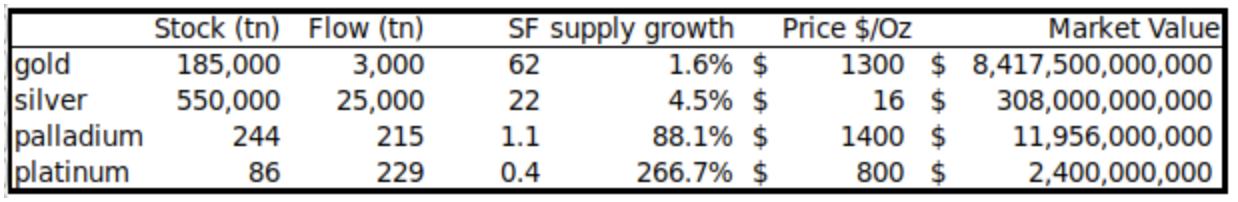

S2F is elegant in its simplicity. You simply divide the current supply (stock) of a commodity or asset by its annual production (flow). When PlanB debuted the bitcoin S2F model in 2019, he included a chart that compared its value with that of other commodities and precious metals with varying degrees of scarcity.

Stock-to-Flow metrics for key precious metals

PlanBThe third column in the chart above (SF) represents the number of years it would take based on current production levels to double the amount of existing supply of an asset. As you can see from the chart, it would take 62 years to pull the current amount of gold out of the ground, making the existing supply relatively scarce. It would take 22 years for silver, while metals that are used more commonly for industrial activities, such as palladium and platinum, have lower ratios. When this chart was first released bitcoin’s S2F was 25, 17.5 million coins/700,000 production per year. This put it above silver but behind gold.

Looking today, bitcoin’s S2F is much higher. It’s total stock has increased to 18.6 million units and because we had a halving last May the issuance schedule was reduced to 328,500, giving it an S2F of 56.6.

How does this compare to gold and silver? According to the World Gold Council there was 197,576 (tn) of above ground stock in 2019, and if we divide that by 3,000 we get a new SF of 65.85. So, gold’s S2F has gone up, but bitcoin (due to the halving as well as the fact that gold production continues to increase due to technological advancement), is making up ground. In fact, one of the big reasons why bitcoin advocates believe in S2F is due to the very fact that its production schedule is immune to such advancements.

Blind Spots

Despite S2F’s accuracy so far, it is not beyond reproach, and when I interviewed PlanB for this story even he made clear that we should be careful to not make the connection that bitcoin’s issuance schedule and relative scarcity are the only reasons for its rise in value. For instance, one of S2F’s big blind spots is demand, which directly relates to intrinsic value. There are thousands of bitcoin copycats with the same issuance schedules, but none can match its demand, and thus its value. PlanB told me that the reason “Is that there is no other asset besides bitcoin that has a truly decentralized nature. And a truly unforgeable scarcity in that respect.”

Additionally, the simplicity of S2F also makes it unable to take into account exogenous factors and black swan effects such as an attack on the bitcoin network or the acceleration boost that bitcoin received last year from the governmental response to Covid and institutional adoption. When I asked him how events such as those that transpired last year fit with the model he was very frank and honest with me, saying that while bitcoin was already on an upward trajectory they definitely had an impact, from first depressing prices in March to then turbocharging the growth of bitcoin as well as stocks and real estate in subsequent months.

Doesn’t Work For Other Assets

Finally, I was curious if he found similar levels of price-prediction accuracy with other crypto assets. However, S2F only seemed to work with bitcoin. He said that he actually tested ten altcoins, including ethereum, litecoin and bitcoin cash but could not find accurate price correlations with their S2Fs. However, he did find correlations between their price and bitcoin’s S2F, which isn’t surprising given how correlated the market is in general.

S2F has proven to be an accurate and valuable price prediction tool for bitcoin, but its top advocate would tell you himself that it is not omniscient. When it comes to bitcoin, as well as other crypto assets, we need to keep using a multidisciplinary approach.

"flow" - Google News

April 29, 2021 at 07:14PM

https://ift.tt/3nwpd5y

Demystifying Bitcoin’s Remarkably Accurate Price Prediction Model, Stock-To-Flow - Forbes

"flow" - Google News

https://ift.tt/2Sw6Z5O

https://ift.tt/2zNW3tO

Bagikan Berita Ini

0 Response to "Demystifying Bitcoin’s Remarkably Accurate Price Prediction Model, Stock-To-Flow - Forbes"

Post a Comment