takasuu/iStock via Getty Images

Antero Midstream (NYSE:AM), the transportation portion of natural gas (NG) producer, Antero Resources (AR), continues growing EBITDA with strong results. Is it enough to return the once higher dividend? And yes, cash flow is the primary, actually, the only commodity of importance for investors at this point. Midstream slashed its dividend some time ago in order to drill additional wells for Resources. It was a very smart move for long-term thinkers. The hope for investors since has been for at least a major portion if not all of the cut returned. In past articles, our thrust has been to follow increases in cash generation and EBITDA. We continue this effort. Let's go grab the change purse, turn it upside down, empty it and count the gold pieces.

The Quarter

For the quarter, Midstream generated $251 million in EBITDA, paid $49 million toward debt, and reduced its leverage to 3.4, down from 3.7 in December of 2022. The EBITDA yearly run rate jumped to just over $900M. Two slides, included in the presentation, summarize in more detail the quarter and its meanings. The first is a summary.

Antero Midstream

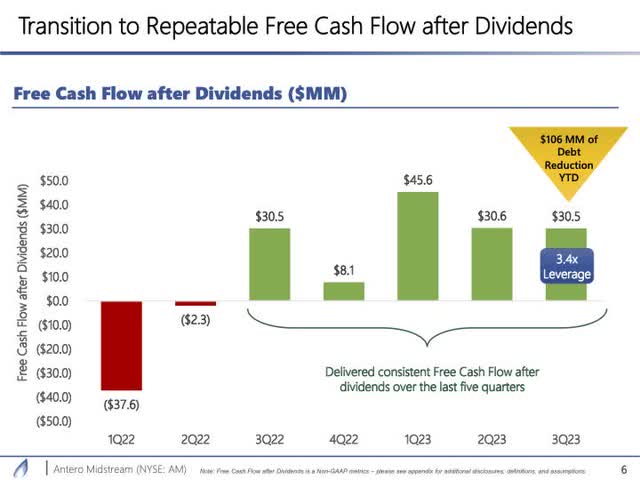

The next shows the progress made in cash flow.

Antero Midstream 3rd Quarter 2023

The company is generating $30M - $40M a quarter at this point in excess cash.

The Objective

A few years ago, management set the leverage target for Midstream at 3.0. This target can be accomplished by increasing EBITDA, or paying off debt, or by some combination of the two. The company approached this using both. With respect to leverage, management noted this in the prepared remarks:

"As we look to 2024, we expect a further meaningful increase in free cash flow after dividends. This will position AM well to achieve our three-time leverage target and increase our return of capital to shareholders."

Once the leverage reaches the target, Midstream's intention was to increase the dividend from $0.90 per year to a yet undetermined level.

Continuing with the Result Evaluation

From our article, Antero Midstream: Sailing Toward Higher Dividends, we included a section illustrating progress toward the above goal. From the article, we, also, included a portion of our critical cash flow table. Numbers bolded are updates.

"With the key element for investors to follow being leverage, we once again include a portion of our table from our last article, balancing cash with EBITDA."

| Leverage Balance (Million Except as Noted) | EBITDA | Capital Quarter | Capital Year-to-Date | Debt Reduction | Debt (Billion) |

| 2023 | $900 -$920 * | NA | $190 ** | $145 *** | $3.23 |

| 2024 |

$1000 * **** |

NA | $140 | $250 | $3 |

* Estimate made from extrapolating the results for the first three quarters (9-months EBITDA equaled 653,178). Lowered 2023 EBITDA by $70 million from our last report.

** Year-end expected at $180 - $200 million.

*** Debt reduction equals the extrapolated value from the first three quarters.

**** Estimate for 2024 (2023 EBITDA estimate times 1.08).

Our EBITDA estimate for 2024 is also bolstered when extrapolating the September results into a full year. It is clear that the company is increasing EBITDA while spending the balance of the cash flow on closing debt. The 2024 estimate of $1Bb suggests that the debt must be lowered to $3.0 billion in order to reach the leverage target or an additional $230 million must be paid. For 2023, the payments will equal approximately $145 million or $85 million short in 2024. The difference in the likely EBITDA being between $80 million to $100 million, equals just enough to reach the goals if the operation continues at this strong pace. But all the gold pieces found in the coin purse will be spent.

An interesting note appeared in the prepared remarks concerning the two bolt-on purchases formerly made.

"Looking back at the Crestwood and EnLink acquisitions, we were well positioned to put both acquisitions on the balance sheet, given our leverage position and visibility over the near term. To put it into context, we expect to essentially pay off both of these acquisitions with just six to seven quarters of excess free cash flow after dividends. . .. This is an incredible feat and highlights just how strong AM's base business is as well as demonstrating how free cash flow accretive those acquisitions were."

It is a feat when considering this in all angles.

The Dividend

For most Midstream investors, it is about the dividend and increases. At the end of next year, the leverage and debt targets are likely to be hit. Midstream has 480 million shares outstanding and pays ninety cents per year in dividends meaning each ten cents equals $48 million. A continued strong performance similar to 2023 suggests that $230 million plus in excess cash, gold coins for investors, could add back the thirty-cent cut from a few years ago leaving approximately $100 million leftover for other uses. But Midstream must empty the wallet to reach its goals. Remember increases are more than a year out.

Risks

With Midstream, risks are a little more difficult to define. A very steep recession might add some worry, but this is the transportation arm, not the production arm. Overseas demand for U.S. produced LNG, a major target for Resources, could be negatively affected. In an article at Oilprice, Tsvetana Paraskova, noted a major negative pricing issue coming with very strong U.S. and world production, a situation which could eventually curb Resource production in a meaningful manner.

When considering yields, our reason to own, we are lifting our rating to a buy with stock prices in the $12.5-$13 range (future yield of 9%), lowering to a sell at prices near or above $14 and a strong buy under $12.

"flow" - Google News

December 24, 2023 at 10:59PM

https://ift.tt/U0IRX5P

Antero Midstream Is Emptying The Wallet (Cash Flow) To Keep Pace (NYSE:AM) - Seeking Alpha

"flow" - Google News

https://ift.tt/vOy3KaL

https://ift.tt/6EuRQCq

Bagikan Berita Ini

0 Response to "Antero Midstream Is Emptying The Wallet (Cash Flow) To Keep Pace (NYSE:AM) - Seeking Alpha"

Post a Comment