The-Tor

Vital Energy, Inc. (NYSE:VTLE) continues to make both large and small acquisitions to increase free cash flow. In the time I have followed this company, it has gone from an asset-based strategy (that few companies survive) while running cash flow deficits until there was a material sale, to a company with free cash flow. Investors have seen the number of shares outstanding balloon. But those same investors can now envision a company that no longer needs to sell material assets for cash to repay debt. Production expansion can be financed from cash flow, while the legacy natural gas assets could prove to be very valuable as the export capacity increases. Margin expansion in this coming fiscal year is likely to be a given. But there could be more of the same ahead as these more profitable properties are developed at the expense of legacy production.

The Strategy

The current management that took control of the company after previous management was shown the door a few years back had to accommodate a new market that required free cash flow to grow and pay dividends. This company began that transition at a considerable disadvantage that resulted in more than a few competitors filing for bankruptcy or being acquired at fire-sale prices.

Now the company made an acquisition of more free cash flow as a result of the previous acquisitions and it did so at about 3 times estimated free cash flow (given the estimates of commodity prices in the press release). Like the three latest acquisitions that were made, this acquisition was done for stock. This further adds to the debt ratio benefit while likely being accretive to shareholders as well.

This continues to raise earnings while assuring the market that the debt ratio will likely still be 1.0 in the coming year even if commodity prices weaken somewhat. The key here is that accepting the potential add-ons, even at the expense of issuing more stock adds to the safety in that the debt guidance becomes more assured at the pricing level used for the guidance. It can therefore withstand a larger unfavorable actual pricing variance than was the case during the original announcement.

This is important because, at current price levels, Mr. Market is attaching a lot of importance to a debt ratio of 1.0 to 1.3 "no matter what." As investors saw during the pandemic, the market and the debt market attached no value to the hedging income even though that enabled many companies to survive the pandemic. It really appeared that the market and the debt market looked at results before hedging.

Shareholder Worries

Shareholders have long been worried or been outright hostile to more shares issued. But this company had little choice when the migration to free cash flow began because it had negative free cash flow. To change that situation without issuing more shares is a pathway that many companies were unsuccessful in doing. I followed many that simply did not issue shares until it was too late to make a difference.

Admittedly, there becomes a time when it might be more advantageous to use debt. But this is a very low visibility industry. For that reason alone, debt does not work real well as it has to be paid (when it is due) no matter the industry climate.

The same people who want share repurchases and dividends need to understand that the debt ratio has to be satisfactory first. The market and the debt market will not tolerate anything less now that the industry has matured.

The fact that prices are cheap enough so that these transactions actually increase earnings per share is "icing on the cake." There were many times in the past when that was not the case.

Guidance Out The Window

Every time one of these transactions happens, then the guidance will change. The main idea is not that any one transaction changes guidance. It is that the strategy over time changes the future materially for the better to the point that current guidance means little until management assures investors the strategy is complete. That has not happened with Vital Energy.

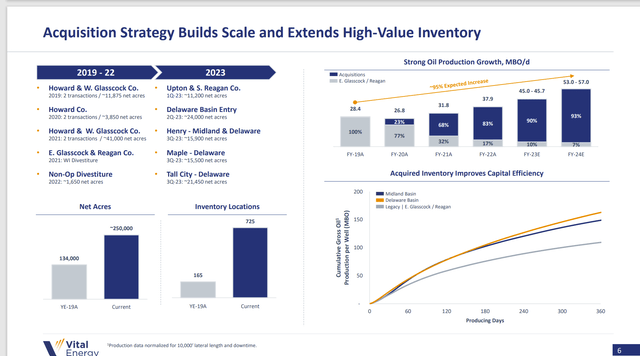

Vital Energy Oil Production Growth Strategy (Vital Energy November 2023, Corporate Presentation)

Management is still pursuing (successfully) the same strategy that began years ago as shown above. This strategy actually has a safety feature in that continuing technology advances happen at a pace that materially improve the deals made over time.

The market insistence of no organic growth combined with the demand for the payment of dividends helps to keep commodity prices reasonably high. The fast growth days while piling up debt are long gone. If there is a large increase in market supply on the way, it will not be from United States producers.

In the meantime, this management is doing deals that are increasing the production per share (over time) as well as lowering the corporate and well breakeven. All of this is happening while pursuing a better financial debt rating that should increase stock price valuation of reported earnings and cash flow as well.

Risks

The latest transaction puts still more stock in the hands of large shareholders. When these large shareholders decide to sell, they can depress the price of the stock until those sales are done. This is more of a near term threat rather than a long-term threat because shares can only be sold once by a large holder. A lot of these sellers do sell not long after the sale to Vital.

The company has grown rapidly. Rapid growth does have its own risks.

The quality of these acquisitions is only beginning to be demonstrated to shareholders. There is a risk that some or all of the acquisitions could disappoint.

Commodity prices are always a risk in this business. Commodity prices can always disappoint "because it is Tuesday." Similarly, commodity prices can sky rocket after the company fully hedged for a disappointing year.

All Of This Means

The latest transaction is relatively small. But the pace of transactions shown above likely means there are more on the way.

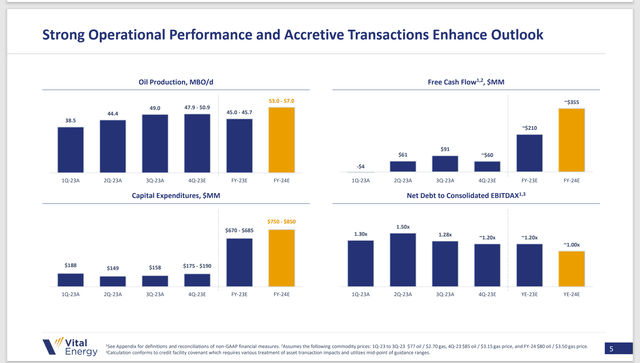

Vital Energy Fiscal Year 2024 Guidance And Historical Trends (Vital Energy Corporate Presentation November 2023)

Therefore, the guidance shown above could well be materially different during the fiscal year. It all depends upon what management is looking for, and what is available.

The big deal is that free cash flow graph. It needs to grow a lot more than is currently there. Management has already grown free cash flow quite a bit in a relatively small amount of time. The result is the debt ratio guidance finally meets both debt market and stock market demands. Now that free cash flow needs to do the same.

Oil production will grow both by replacing legacy natural gas production with new production that has a higher percentage of oil production and through continuing acquisitions.

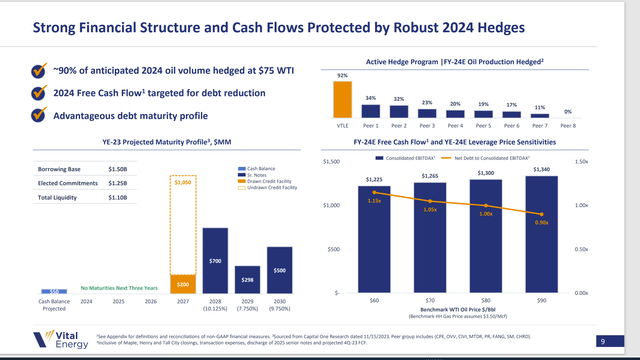

Vital Energy Key Financial Statistics And Debt Duration Graph (Vital Energy Corporate Presentation November 2023)

Management is demonstrating to shareholders that the transition is not yet complete by stating that cash flow will go towards debt reduction. The acquisition strategy will slow or even cease when there is a suitable amount of money available for dividends. That appears to be a few years away.

On the other hand, there is no debt due for a while. Therefore, management has plenty of time to "get its house in order." The other clue that finances still need some work is that management is hedging 90% of the production. The need for hedging probably needs to drop to 40% or less.

Clearly management has made spectacular progress since it took over. It is also "clearly" that more work needs to be done.

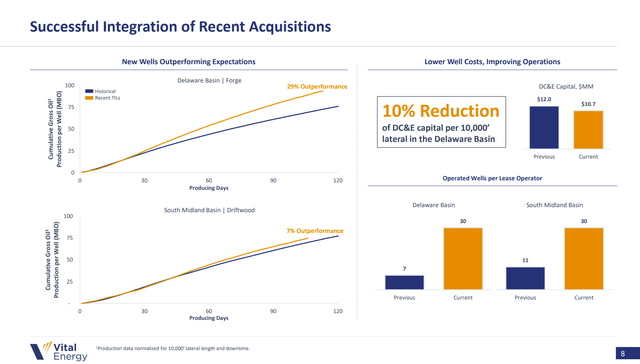

Vital Energy Acquisition Progress (Corporate Presentation November 2023)

So far, so good with the acquisitions as shown above. Enough progress like what is shown above will likewise improve the cash flow picture.

Many industry insiders tend to make companies more valuable through operational improvements like the ones shown above. Many investors, on the other hand, believe that a lot of financial leverage is necessary. Yet a lot of the acquisitions that I covered seem to suit the management preference better than the investor preference.

Time will tell how all of this works out. But based upon the management progress, Vital Energy, Inc. remains a strong buy as long as investors realize that the future could be materially different and likely better than the guidance shown above.

"flow" - Google News

December 23, 2023 at 06:23AM

https://ift.tt/YCR5pyb

Vital Energy: Cheap Free Cash Flow (NYSE:VTLE) - Seeking Alpha

"flow" - Google News

https://ift.tt/x1mt28l

https://ift.tt/KgG1Slb

Bagikan Berita Ini

0 Response to "Vital Energy: Cheap Free Cash Flow (NYSE:VTLE) - Seeking Alpha"

Post a Comment