You do not have to focus on the Magnificent Seven to find some huge 2023 winners. General Electric Co.'s (NYSE:GE) shares have soared more than 80% this year, settling last week at the best mark since Nov.10, 2017. Up more than 10% since its last earnings date, the blue-chip stock paces for its best year in more than six decades.

I like what is happening with GE as its rivals struggle. While the valuation is high right now, earnings per share growth is expected to be robust while the technical situation suggests upwards of 40% upside from here. Being mindful of important risks is critical, though.

GE On Pace for its Best Year Since At Least the Early 1960s

Company description

According to Bank of America Global Research, GE is a global conglomerate with diversified operations in its Aerospace, Power and Renewable Energy segments. Its products and services include power generation, aircraft engines, renewable energy and other data technology niches, though it spun off its health care unit in December 2022 and it is expected that GE Aerospace and Vernova spinoffs will be completed in the coming months. The company does business in Europe, China, Asia, the Americas, the Middle East and Africa.

Key data

With a $133 billion market cap, the Boston-based company within the Industrials sector trades at a high 46.2 forward non-GAAP price-earnings ratio and pays a low 0.3% forward dividend yield. With earnings due out next month, shares feature a low 19% implied volatility percentage, according to Option Research & Technology Services. Short interest on the stock is modest at just 0.7% as of Dec. 1.

Earnings review

Back in October, GE reported a strong third quarter. Non-GAAP earnings of 82 cents per share topped estimates by 26 cents while $17.3 billion of revenue, up almost 20% from the same period a year earlier, was an impressive $1.61 billion beat. The company reported total orders of $17.9 billion, a 19% year-over-year gain, with organic orders higher by 18% annually. Organic margins also expanded by 760 basis points year over year.

Guidance and risks

Sending shares higher were not just the third-quarter operating results, but also a healthy 2023 guide and balance sheet improvements. Adjusted earnings per share is now seen in the $2.55 to $2.65 range compared to the consensus of $2.34 at the time and prior guidance of $2.10 to $2.30. General Electric expects free cash flow of nearly $5 billion this year. Future spinoffs at GE Aerospace and GE Vernova (Renewable Energy & Power) should help the management team focus on its core segments. Also beneficial for shareholders is the company's focus on reducing its balance sheet by paying off debt. Key risks include any hiccups in the cyclical aerospace segment and any disruptions in the power segment due to higher interest rates today.

Another unknown is how the spinoffs proceed given some executive changes. I do not expect this to be a major negative headline risk, but several leadership changes were announced last month. Of course, once the spinoffs are completed, GE shares themselves will be generally immune to operational and execution challenges, should they occur, at the new companies.

Valuation

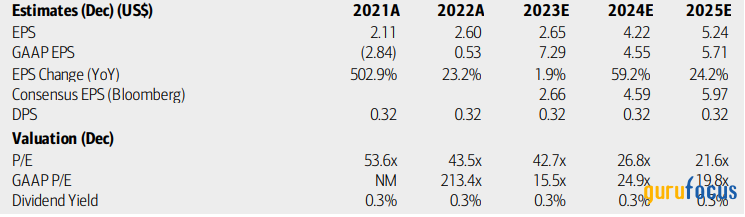

On valuation, analysts at Bank of America see non-GAAP earnings being about flat for 2023. Sales growth is forecasted to drop about 15% this year before top-line growth resumes in 2024 with further gains in 2025. Consensus out-year earnings per share is near $4.60 and per-share profits could top $6 by 2025 based on strong upward earnings revisions in the last handful of weeks. Dividends, meanwhile, are expected to hold steady at just 32 cents per share, making for a below-market yield, but rising free cash flow may allow for shareholder-accretive activities in the years ahead. Still, with robust growth GE's earnings multiple should retreat over the coming quarters if the stock price holds steady.

If we apply a 23 times multiple, half its five-year average forward operating price-earnings ratio, on $6 of expected 2025 earnings per share, then shares should be near $138. I assert that a low-20s multiple is right given a more than doubling of earnings per share from 2023 to 2025. Also, that would be about a 13 times enterprise value/Ebitda valuation using 2025 numbers, on par with its peers.

GE: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

Source: BofA Global Research

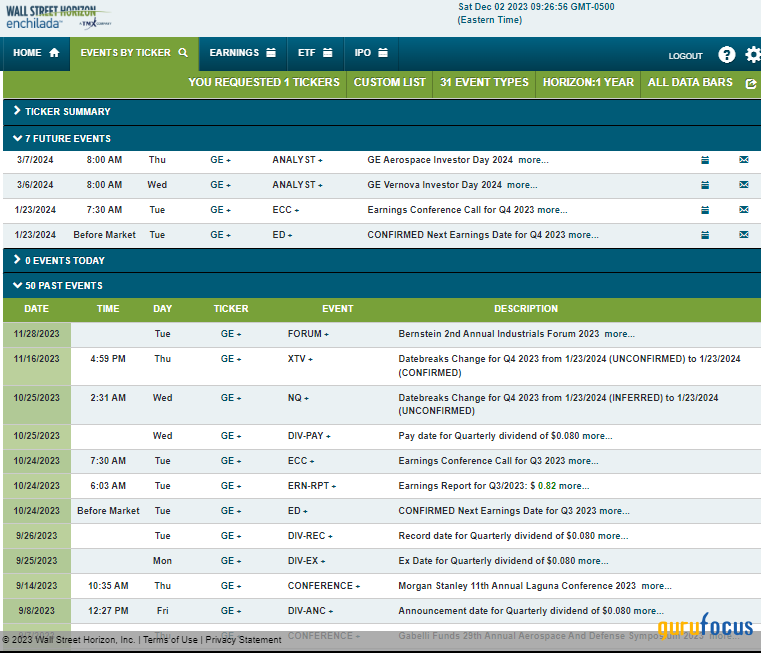

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed fourth-quarter 2023 earnings date of Tuesday, Jan. 23 with a conference call immediately after the numbers cross the wires. Later in the quarter, the company's management team is expected to present spinoff figures and offer color on operations in its GE Vernova Investor Day on March 6 and GE Aerospace Investor Day on March 7 so keep those dates on your calendar for potential volatility.

Corporate Event Risk Calendar

Source: Wall Street Horizon

The technical take

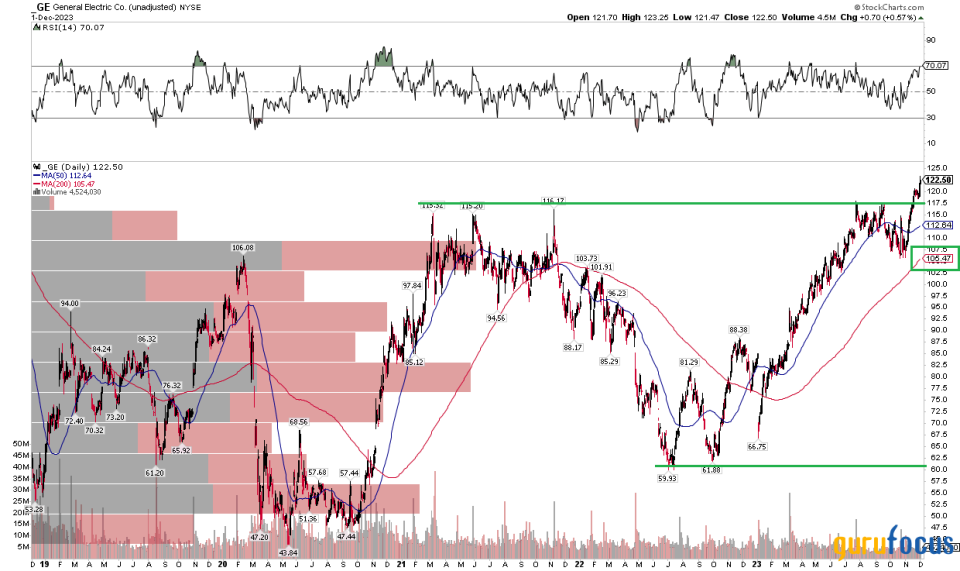

Shares of General Electric have endured a volatile past. The stock peaked at $484 in 2000 during its turn-of-the-century heyday. Shares cratered during the dot-com bubble, but then came back to life during the 2002 to 2007 bull market, hitting a rebound high of $337 in 2007 immediately before the Great Financial Crisis. Troubles in its GE Capital unit led to a more than 80% plunge to under $50 and a lower high was notched in 2016 at $264. The stock briefly undercut its financial crisis low in March 2020, but are now at fresh highs dating back to 2018.

Notice in the chart below that a healthy uptrend is in place. The long-term 200-day moving average is trending up in a linear fashion, currently at $105. Following a consolidation from this past July through October, GE is once again moving up. With bullish momentum in clear view, one chart pattern points to further upside ahead. A measured move price objective to the $170 to $175 range is in play following a breakout through $117 resistance a cup and handle pattern with a height of $56 suggests about 40% of potential gains ahead. Of course, that is just one indicator, but with the RSI momentum oscillator printing fresh multi-month highs, the strong price action is confirmed by momentum. Long with a stop under $110 appears to be a favorable risk-reward idea.

Overall, GE looks strong from a technical perspective following the upside breakout.

Upside Cup and Handle Breakout, Target Above $170

Source: Stockcharts.com

The bottom line

GE appears healthy from a fundamental and technical point of view. While its valuation is lofty, I see strong momentum heading into 2024.

This article first appeared on GuruFocus.

"flow" - Google News

December 07, 2023 at 05:32AM

https://ift.tt/B12jGWK

Strong Execution From GE as Spinoffs Pending, Free Cash Flow on the Rise - Yahoo Finance

"flow" - Google News

https://ift.tt/0c3evFz

https://ift.tt/3K70p1W

Bagikan Berita Ini

0 Response to "Strong Execution From GE as Spinoffs Pending, Free Cash Flow on the Rise - Yahoo Finance"

Post a Comment